Update on global economy, India Budget highlights and US monetary policy

The week gone by saw two major economic events relevant for India along with a key economic forecast update for the global economy

1. Taking stock of global economic forecasts

The International Monetary Fund in its quarterly review of the global economy presented few notable changes in its key economic forecasts.

- While World GDP growth forecast for 2023 got revised up, projection for the incremental loss of momentum compared to 2022 remains unchanged at 50 bps. The mark-up predominantly reflects the re-opening impact of the Chinese economy.

- Recovery expectation for 2024 remains intact; although it is likely to be mild, with World GDP growth forecasted to be lower vs. the long term (2000-19) average of 3.8%.

- Forecast for volume of world trade (goods + services) saw a downward revision for both 2023 and 2024, although 2024 continues to depict a moderate recovery in global trade volumes.

IMF’s key global economic forecasts (%, as of Jan-23)

| 2022 Estimate | 2023 Forecast | 2024 Forecast | |

| World GDP | 3.4 (+0.2) | 2.9 (+0.2) | 3.1 (-0.1) |

| US | 2.0 (+0.4) | 1.4 (+0.4) | 1.0 (-0.2) |

| Eurozone | 3.5 (+0.4) | 0.7 (+0.2) | 1.6 (-0.2) |

| UK | 4.1 (+0.5) | -0.6 (-0.9) | 0.9 (+0.3) |

| China | 3.0 (-0.2) | 5.2 (+0.8) | 4.5 (no change) |

| India | 6.8 (no change) | 6.1 (no change) | 6.8 (no change) |

| World Trade Volume (Goods + Services) | 5.4 (+1.1) | 2.4 (-0.1) | 3.4 (-0.3) |

Data: IMF, QuantEco Research

In the near term, the massive earthquake in Turkey (besides its humanitarian impact) is likely to have a mild impact on India’s exports, which stood at USD 10.0 bn in 2022 (2.2% in India’s export basket). As per the Global Trade Research Initiative, suspension of one of the two main container ports is Turkey will delay shipments and could potentially take about a month to normalize its activity. It is likely that discretionary items like Yarns, Dyes, and Gems & Jewellery could see negative export growth in Feb-Mar 2023.

2. Key takeaways from the 2023-24 Union Budget

- Target for fiscal deficit was lowered to 5.9% of GDP from 6.4% in 2022-23.

- While the Budget refrained from any big bang policy announcements, quality of spending got a significant boost with hike in allocation for capital expenditure to a two decade high of 3.3% of GDP from 2.7% in 2022-23. Bulk of the capex in 2023-24 would be driven by railways, roads, defence, telecom, petroleum, and housing & urban development.

- From exports perspective, the Budget hiked allocation for some key schemes like the Remission of Duties and Taxes on Export Products (up 10.0% to Rs 15069 cr), Rebate of State and Central Taxes and Levies (up 12.7% to Rs 8405 cr), and Interest Equalisation Scheme (up 23.4% to Rs 2932 cr). This is expected to help improve cost efficiency for SME exporters.

- Targeted reduction in import duty for specific products will build on

addto the competitiveness of exports of chemical products, marine products, gems & jewellery, and electronic items. In addition, the Budget increased the allocation for the PLI (Performance Linked Incentives) Scheme by 67.7% to Rs 8,083 cr, with bulk of the increase earmarked for electronics & hardware, food processing, automobiles, and pharmaceuticals sector.

3. US central bank normalizes rate hikes

The US Federal reserve announced a 25 bps rate hike on Feb 1st , taking the fed funds rate range to 4.50-4.75%, taking cumulative tightening done since 2022 to 450 bps. Market participants expect one further round of 25 bps rate hike in Mar-23 before the Fed gets into a pause.

The downshift in Fed’s monetary policy aggression will reduce the pressure on other central banks. As expected, the RBI has also stepped down in magnitude of rate hike to 25 bps in Feb-23 from 35 bps in Dec-22. Going forward, we expect the RBI to announce its last rate hike of 25 bps in Apr-23, after which it could get into a pause mode for impact assessment.delivered its final 25 bps rate hike in the current tightening cycle on Feb 8th, after which it is expected to maintain an extended pause.

INR: Starts 2023 on a positive note, but mild depreciation bias to persist

The Indian Rupee appreciated by 1.0% in the month of Jan-23, which was predominantly a reflection of underlying weakness in the US Dollar. Expectation of rate hike cycle ending earlier in US vis-à-vis its key peers is weighing upon the dollar. While this could provide some near-term appreciation pressure on INR, we believe the RBI would use this opportunity to rebuild FX reserves (by purchasing USD) and thereby limit INR appreciation. We continue to expect USDINR to trade close to 83.5 levels by Mar-23, and towards 85.5 levels by Mar-24 on likelihood of persistence in India’s Balance of Payments Deficit.

INR: Starts 2023 on a positive note, but mild depreciation bias to persist

The Indian Rupee appreciated by 1.0% in the month of Jan-23, which was predominantly a reflection of underlying weakness in the US Dollar. Expectation of rate hike cycle ending earlier in US vis-à-vis its key peers is weighing upon the dollar. While this could provide some near-term appreciation pressure on INR, we believe the RBI would use this opportunity to rebuild FX reserves (by purchasing USD) and thereby limit INR appreciation. We continue to expect USDINR to trade close to 83.5 levels by Mar-23, and towards 85.5 levels by Mar-24 on likelihood of persistence in India’s Balance of Payments Deficit.

India’s FX reserves have increased for four consecutive months

Note: Data is for end of month; for Jan 2023, it is for week ending 27th. Change in reserves can be on account of actual purchase/sale of dollars and gold by the RBI along with revaluation impact.

Data: RBI, QuantEco Research

* BoP deficit for 2022-23 is our forecast. Change in USDINR in 2022-23 is as of Jan 17th.

What should Exporters Do ?

- Be cautious on Buyer Credit risk and mitigate 100% of the exposure using Export Factoring or Credit Insurance (ECGC, private) for all of their exports. 2023 still seems quite a volatile year and not the time to take any form of risk on Buyers (for open account business).

- There is expectation that this year sizable demand from US/EU that was catered by China will move to India (China + 1) especially across Synthetic Apparels, Pharma, Metal fabricated products, handicrafts, toys, leather products, etc. This can be a good opportunity to build scale for Indian exporters.

Website: https://www.quanteco.in/

Export assessment survey, export credit, and Budget expectations

As 2023 commences, we take this opportunity to look beyond usual export statistics and evaluate how the enabling environment appears from the perspective of sentiment, finance, and expectations from the upcoming Union Budget 2023-24.

1. Export sentiment

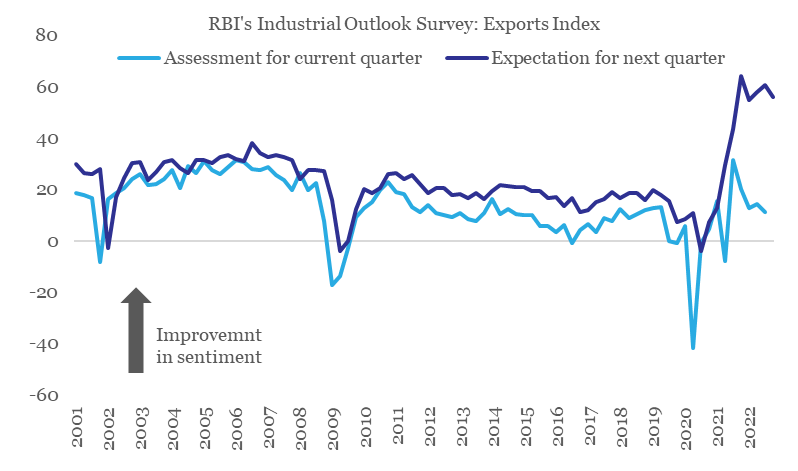

As per RBI’s Industrial Outlook Survey, the index for exports (capturing current assessment and expectations) has been on a declining trend after peaking out in Q2-Q3 of 2021-22. This trend in survey-based sentiment indicators for exports appears to be confirming the slowdown in external demand.

Export sentiment on a declining trend

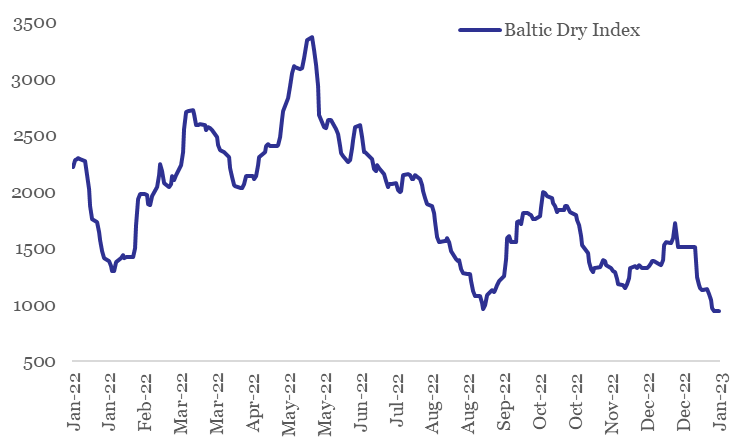

From near term perspective, the sharp slide in Baltic Dry Index1 (-37.6% in Jan-23 so far) is concerning and points towards tepid global trade. However, the impact currently is likely to be exaggerated on account of Chinese New Year holiday and the upcoming monsoon season in Brazil. In fact, with easing of COVID restrictions and re-opening of Chinese economy, global trade could see a spurt in near term momentum (post the commencement of the extended holiday season).

Sharp slide in Baltic Dry Index in Jan-23

2. Export financing

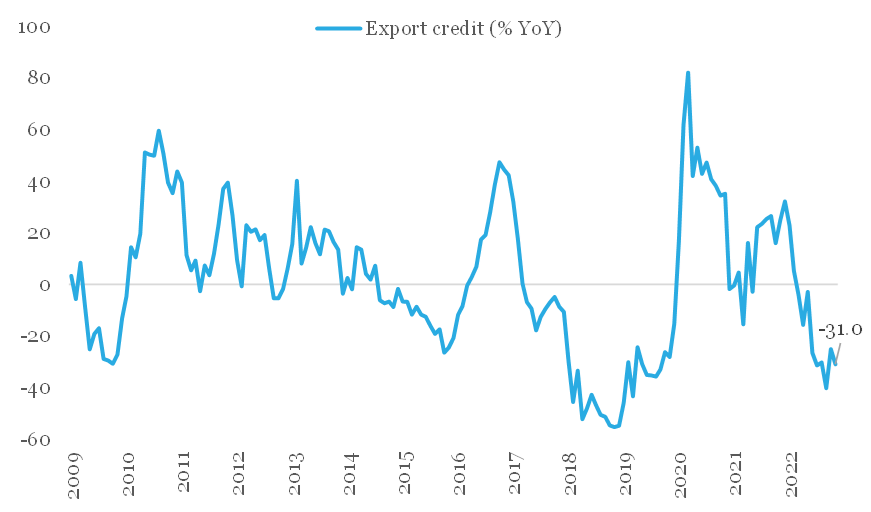

Amidst slowdown in India’s exports, export financing has also seen a sharp decline – on annualized basis, export credit has been in contraction since Mar-22. The overall value of outstanding export credit from banks has fallen to Rs 15,506 cr in Nov-22 from Rs 23,621 cr in Mar-22. As per media reports, with demand uncertainty persisting, exporters are either delaying shipment orders or are not extending the terms of the contract.

Export credit has contracted for nine consecutive months

3. Expectations from the 2023-24 Union Budget

Amidst headwinds from slowing demand and rising cost burden, the government could be considering raising interest equalization or subsidy benefits (by up to 2%) extended to MSME exporters. This is likely to benefit exporters from labour-intensive sectors like ready-made garments, toys, handicrafts, auto components, and processed food. In addition, the government could also be considering laying incentives for setting up of domestic Testing & Certification centres for MSME exporters and expansion of TReDS (Trade Receivables Discounting System) services to cover larger number of MSMEs and PSUs/ Corporates.

INR: Under BoP2 pressure

India’s net balance of payment (BoP) registered a deficit of 3.7% of GDP in Jul-Sep quarter of 2022-23 – this was the widest deficit since the 2008 Global Financial Crisis. Wide trade/ current account deficit and insufficient capital flows to fund them were the key underlying reasons for the same.

A BoP deficit reflects greater demand for dollars, and hence pressure on rupee. As such, INR weakened by 3.0% during Jul-Sep quarter of 2022-23 (moving from 78.97 in Jun-22 to 81.34 in Sep-22) despite heavy intervention by the RBI. With INR weakening by a further 1.7% in Oct-Dec quarter of 2022-23, we expect BoP deficit to have persisted, albeit at a moderate level.

While this would reduce the pressure on INR, bias for mild weakness is nevertheless likely to persist. As such, we expect USDINR to trade close to 83.5 levels by Mar-23, and towards 85.5 levels by Mar-24.

BoP deficits have always caused depreciation in INR

| Year | Size of BoP Deficit (% of GDP) | Change in USDINR (%) |

| 1995-96 | -0.3 | 8.0 |

| 2008-09 | -1.8 | 26.3 |

| 2011-12 | -0.8 | 14.3 |

| 2018-19 | -0.1 | 6.3 |

| 2022-23* | -1.1 | 7.9 |

* BoP deficit for 2022-23 is our forecast. Change in USDINR in 2022-23 is as of Jan 17th.

What should the Exporters Do ?

- Be watchful of Buyer credit worthiness given the heightened uncertainty and volatility expected during the next 12 months across interest rates, commodity prices and weakening demand in Buyer Countries.

- Diversification of Buyer Geographies is the dominant theme: Middle East esp. Saudi Arabia, UAE etc. seem to be performing quite well. South East Asia overall seems to be impacted far lesser as compared to western economies.

- Avail Factoring or Credit Insurance (private or Govt. ECGC) without fail on all exports.

Footnotes:

1. The Baltic Dry Index is a comprehensive measure of cargo rates for capesize, panamax and supramax shipping vessels carrying dry bulk commodities.

2. Balance of Payments (BoP) is the net dollar flow position into the country on account of current account (trade, repatriation, interest & dividend income) and capital account transactions (foreign investments, external commercial borrowings, banking capital, etc.).

Website: https://www.quanteco.in/

Who moved my exports and exchange rate?

As per the World Trade Organization, growth in global merchandise trade volume is expected to slip to 1.0% in 2023 (slowest since the initial COVID outbreak in 2020) from 3.5% in 2022.

Who is pulling down India’s exports?

The global merchandise trade environment is looking sombre due to multiple shocks:

- US: Aggressive monetary policy tightening would hit interest-sensitive spending in areas such as housing, motor vehicles and fixed investment.

- Europe: High energy prices stemming from the Russia-Ukraine war will raise manufacturing costs and squeeze household spending.

- China: Slowdown in real estate sector and COVID related uncertainty is weighing upon supply chains.

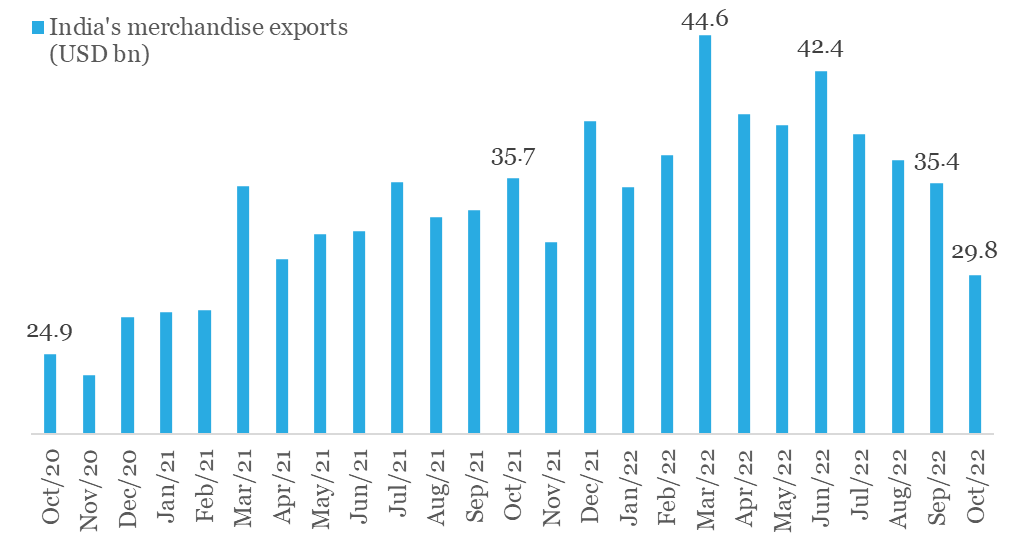

For India, the second half of FY23 started on a cautious note as far as external trade is concerned. While both exports and imports have eased from their respective monthly peaks, the slowdown in exports is concerning.

- From its monthly peak of USD 42.4 bn in Jun-22, exports are down by ~30% to USD 29.8 bn in Oct-22

- For the first time in 20-months, monthly exports fell below USD 30 bn in Oct-22

- Exports posted their first annualized contraction (-16.7% YoY) in last 20-months

India’s exports have been easing since its FY23 monthly peak in June

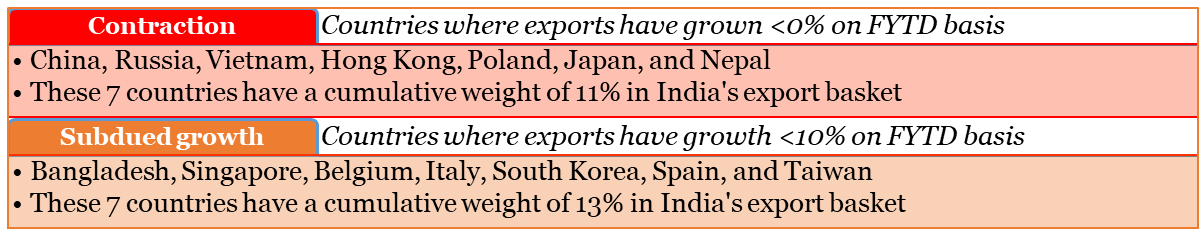

Focusing on key countries (having more than 0.5% share in India’s exports), we find that drag on India’s exports in FY23 so far is coming from:

FX commentary

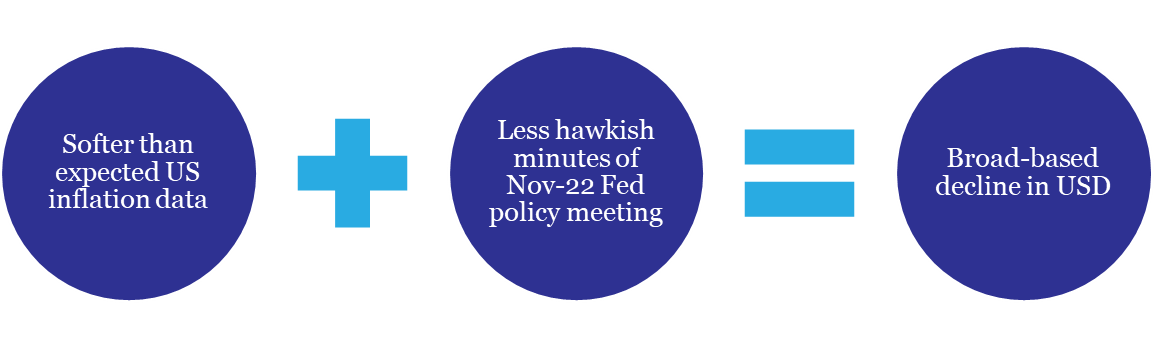

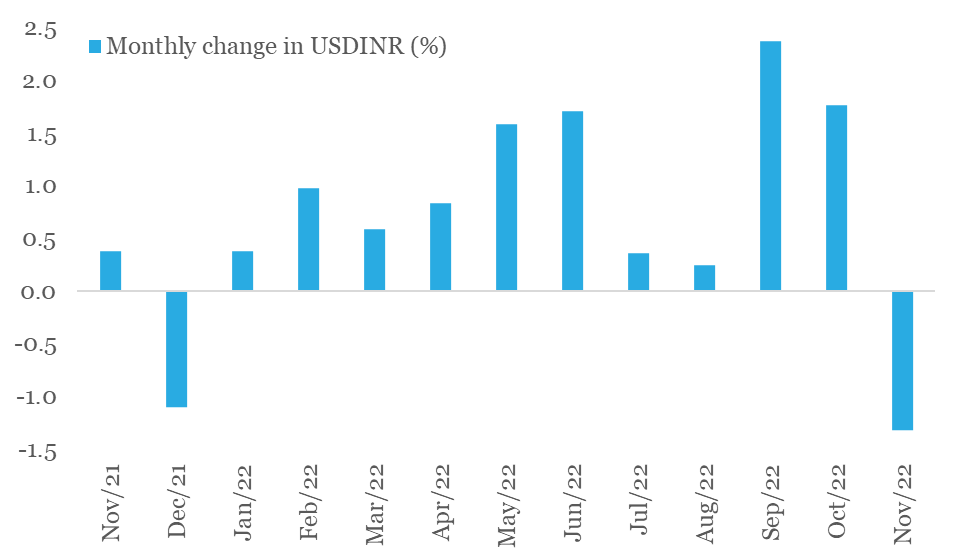

With Nov-22 drawing to an end, we cannot help but notice the first monthly appreciation in Indian rupee after a gap of 11-months. This happened on the back of a broad-based decline in the US dollar (the DXY Index has fallen by 5.1% in Nov-22 so far, making it the worst monthly loss for the dollar in over 12-years).

While the down move in DXY index has been swift, we are not convinced of its durability yet:

- Although market participants now anticipate the Fed to prune its aggression by dialing down the pace of rate hike to 50 bps in the next couple of meetings from 75 bps in last four policy meets, expectations with respect to the terminal fed funds rate (i.e., peak monetary policy rate in the current cycle) have moved up to 5.00-5.25% from 4.50-4.75% earlier (as per the last median forecast provided by the Fed in Sep-22).

- Going into 2023, the Fed will reduce its balance sheet by a further USD 1.1tn, way ahead of any other major central bank. This mop up of global dollar liquidity would continue to support the USD.

- Build-up of relatively higher recessionary risks in Europe and elevated geopolitical risk premium could sporadically boost safe haven appeal of the USD.

As such, we expect residual pressure on rupee to persist, albeit to a mild degree. Our fundamental view on USDINR is guided by our call of USD 130 bn deficit on India’s current account deficit in FY23, accompanied by USD 50 bn deficit on Balance of Payments (i.e., current account deficit adjusted for total net capital inflows).

INR poised for its first monthly gain in 2022

Website: https://www.quanteco.in/

The product mix of India’s exports – what’s growing or falling?

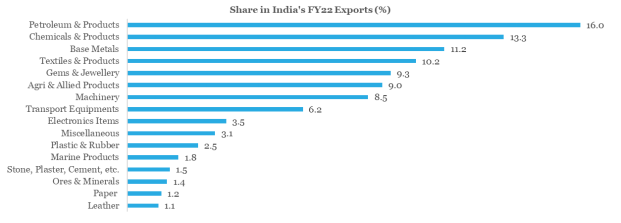

Category wise share of exports is a function of prevailing price and quantity demanded. Four key product categories, viz. Petroleum, Chemicals, Base Metals, and Textiles constituted ~51% of India’s exports in 2021-22.

Top 4 Categories have a share of ~51% in India’s export basket

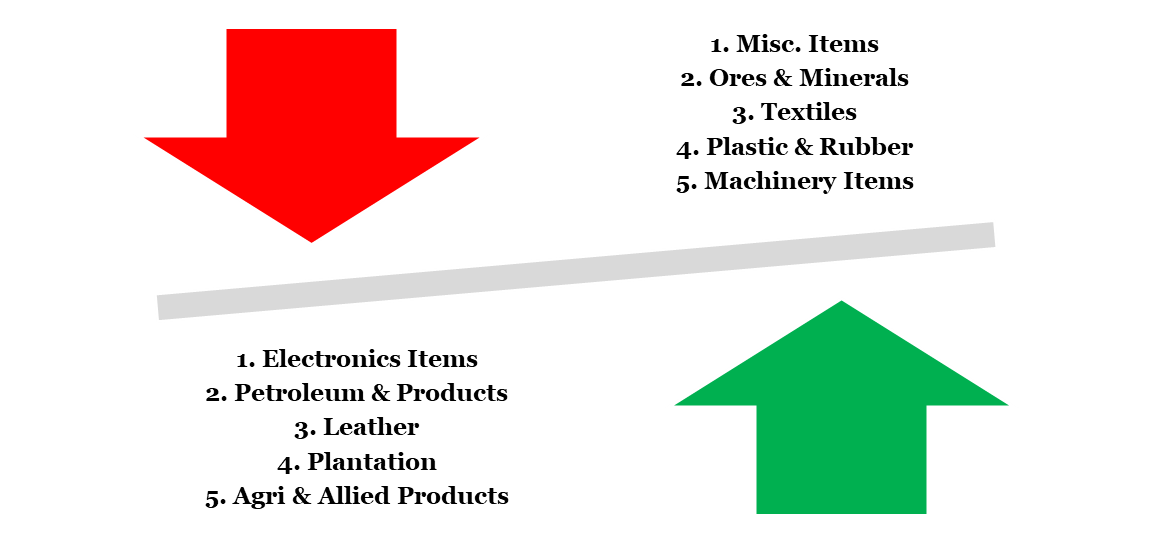

Share in export basket does not dictate performance or growth, which among others is a function of changes in macro environment, competitiveness, quality, and policy support. In 2022-23 so far (Apr-Nov), the Top 5 winners and losers from growth perspective are illustrated below.

Top 5 and Bottom 5 commodity exports (basis YoY growth over Apr-Nov 2022-23)

Electronics has been a massive outperformer this year with 54.4% YoY growth over Apr-Nov period. The sector has benefitted from the Atmanirbhar policy thrust, with PLI (Performance Linked Incentives) Scheme acting as a differentiator amidst the geopolitical backdrop of key manufacturers opting for supply chain diversification (via ‘China+1’ strategy, Onshoring, Friend Shoring, etc.).

As per our estimates, discretionary items1 had a share of ~32% in India’s exports (excluding defence) in 2021-22. With World GDP expected to see a sharp slowdown in 20232 on account of accelerated tightening of interest rates and persistence of geopolitical uncertainty, demand for discretionary exports (like electronics, leather, textiles, etc.) could face severe challenges.

Central banks: Rate hikes continue despite step down in monetary policy aggression

Amidst deceleration in inflation from peak levels, most key central banks have moderated the pace of rate hikes in last 1-2 months. While monetary tightening continues across the globe, there are now subtle differences emerging.

- The US Federal Reserve moderated its pace of rate hike to 50 bps in Dec-22 policy review from 75 bps in previous four occasions. However, Fed’s projection of the terminal fed funds rate, i.e., peak monetary policy rate in the current cycle has now moved up to 5.00-5.25% (to be achieved by Mar-23) from 4.50-4.75% in Sep-22. In addition, the Fed has projected rates to remain unchanged thereafter in 2023 – in contrast to market expectation of at least one round of 25 bps rate cut before the end of 2023.

- The Bank of England moderated its pace of rate hike to 50 bps in Dec-22 policy review from 75 bps earlier. The voting pattern appears mildly dovish (with 2 out of 9 members voting for no hike).

- Back home, the RBI too moderated its pace of rate hike to 35 bps from 50 bps in previous three occasions. Like BoE, the voting pattern shows a mild tilt towards dovishness (1 member voted for no change in rates, while 1 is likely to have voted for a neutral policy stance).

- While the European Central Bank too moderated its pace of rate hike to 50 bps in Dec-22 policy review from 75 bps in previous two occasions, the accompanying policy commentary was hawkish complemented by the announcement of the beginning of quantitative tightening3.

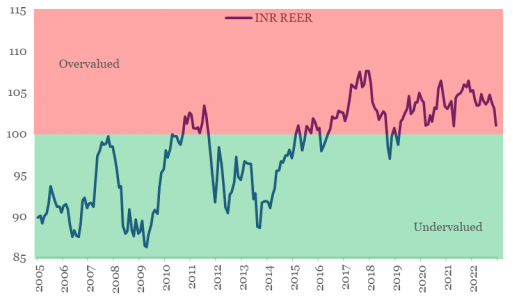

INR: Correction in overvaluation4

_______________________________________________________________

1: Discretionary items exclude plantation products, industrial products, specialized products, and crude oil from total export basket

2: As per the IMF, World GDP growth is projected to slow down to 2.7% from an estimated level of 3.2% in 2022.

3: Quantitative tightening refers to the selling of securities by the central bank to curb domestic liquidity

4: Real Effective Exchange Rate is used as one of the theoretical indices to judge domestic currency’s valuation vis-à-vis its trading partners. The index is adjusted for inflation differentials with trading partners. By virtue of construction, 100 is considered as the fair value for the domestic currency, with higher values signifying overvaluation, and vice versa

We believe US Fed’s ‘higher for longer’ monetary tightness is likely to provide a key source of support to the dollar. In addition:

- Going into 2023, the Fed will reduce its balance sheet by a further USD 1.1 trillion, way ahead of any other major central bank. This reduction of global dollar liquidity would continue to support the USD and cause INR to depreciate against the Dollar.

- Build-up of recessionary risks in Europe and elevated geopolitical risk premium could sporadically boost safe haven appeal of the USD and cause volatility in INR.

Notwithstanding our expectation of a sturdy USD, the recent softness has provided an opportunity to the RBI to shore up some of its lost foreign exchange reserves during Apr-Oct FY23. India’s FCA (Foreign Currency Assets) has risen by USD 26 bn since end Oct-22. With RBI’s active dollar purchases being one of the reasons behind recent increase in India’s foreign exchange reserves, INR has not been able participate in the rally in global currency market vis-à-vis the USD.

On the contrary, INR has weakened against 34 out 40 currencies (used by the RBI to compute rupee’s real effective exchange rate) in Dec-22 so far. This underperformance is helping to correct INR’s overvaluation. As per our estimates, the REER for rupee has moved lower from 103.1 in Nov-22 to close to 101.0, its lowest levels in last 20-months. An orderly correction of overvaluation in rupee is welcome as it helps in improving export competitiveness in the medium term.

Rupee’s overvaluation has seen a correction in last 2-months

Our fundamental view of 84 on USDINR by Jun-23 continues to remain unchanged. US Fed’s indication of ‘higher for longer’ monetary policy rate, RBI’s penchant for opportunistic reserve accumulation, and our Balance of Payments (i.e., current account deficit adjusted for total net capital inflows) call of USD 50 bn deficit would continue to drive mild weakness in rupee.

What should the Exporters Do ?

- Look at diversifying new orders away from Developed economies – US, EU etc. where due to high interest rates, clearly there is going to be a drop in discretionary spend. Middle East esp. Saudi Arabia, UAE etc. seem to be performing quite well. South East Asia overall seems to be impacted far lesser as compared to western economies due to ongoing adverse macro-economic developments.

- Ensure necessary due diligence on Buyers with relevant financial creditworthiness checks given the uncertain times, we are witnessing delay in shipment schedules across retailers with request to suppliers to hold back shipments post production even for confirmed orders. Working with Factoring companies for exports mitigates the buyer non-payment risk.

Website: https://www.quanteco.in/