As per the World Trade Organization, growth in global merchandise trade volume is expected to slip to 1.0% in 2023 (slowest since the initial COVID outbreak in 2020) from 3.5% in 2022.

Who is pulling down India’s exports?

The global merchandise trade environment is looking sombre due to multiple shocks:

- US: Aggressive monetary policy tightening would hit interest-sensitive spending in areas such as housing, motor vehicles and fixed investment.

- Europe: High energy prices stemming from the Russia-Ukraine war will raise manufacturing costs and squeeze household spending.

- China: Slowdown in real estate sector and COVID related uncertainty is weighing upon supply chains.

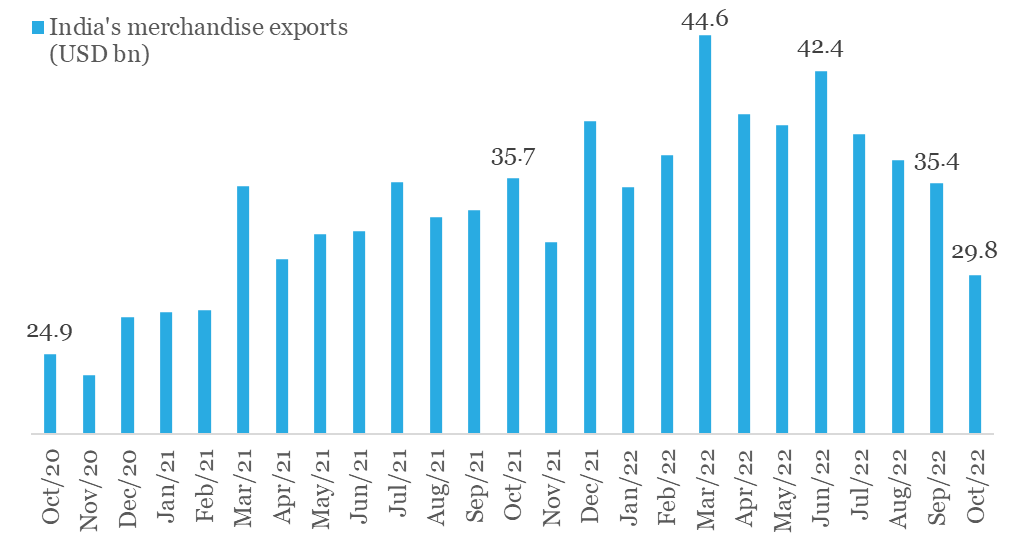

For India, the second half of FY23 started on a cautious note as far as external trade is concerned. While both exports and imports have eased from their respective monthly peaks, the slowdown in exports is concerning.

- From its monthly peak of USD 42.4 bn in Jun-22, exports are down by ~30% to USD 29.8 bn in Oct-22

- For the first time in 20-months, monthly exports fell below USD 30 bn in Oct-22

- Exports posted their first annualized contraction (-16.7% YoY) in last 20-months

India’s exports have been easing since its FY23 monthly peak in June

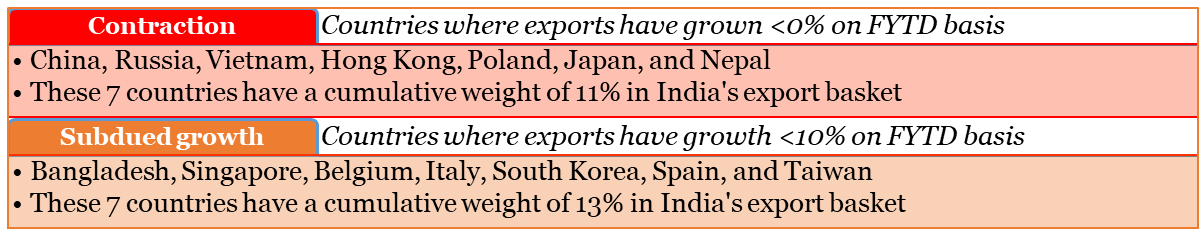

Focusing on key countries (having more than 0.5% share in India’s exports), we find that drag on India’s exports in FY23 so far is coming from:

FX commentary

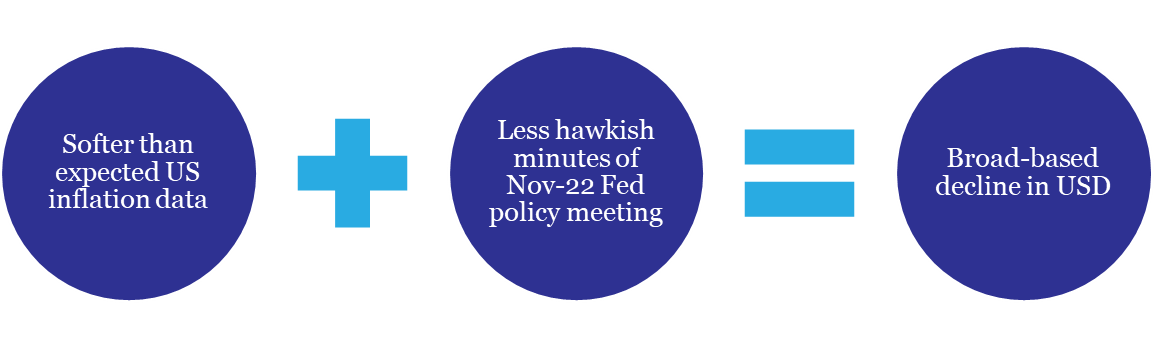

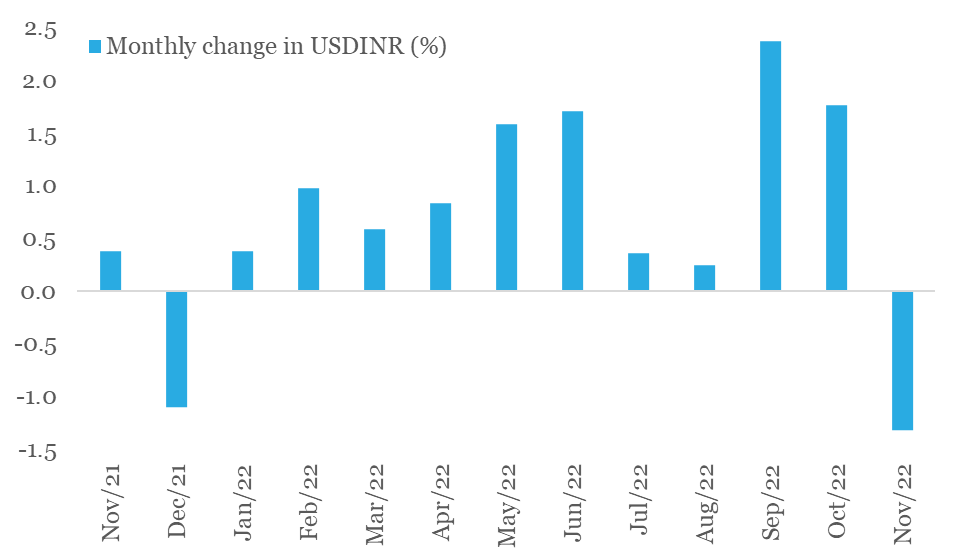

With Nov-22 drawing to an end, we cannot help but notice the first monthly appreciation in Indian rupee after a gap of 11-months. This happened on the back of a broad-based decline in the US dollar (the DXY Index has fallen by 5.1% in Nov-22 so far, making it the worst monthly loss for the dollar in over 12-years).

While the down move in DXY index has been swift, we are not convinced of its durability yet:

- Although market participants now anticipate the Fed to prune its aggression by dialing down the pace of rate hike to 50 bps in the next couple of meetings from 75 bps in last four policy meets, expectations with respect to the terminal fed funds rate (i.e., peak monetary policy rate in the current cycle) have moved up to 5.00-5.25% from 4.50-4.75% earlier (as per the last median forecast provided by the Fed in Sep-22).

- Going into 2023, the Fed will reduce its balance sheet by a further USD 1.1tn, way ahead of any other major central bank. This mop up of global dollar liquidity would continue to support the USD.

- Build-up of relatively higher recessionary risks in Europe and elevated geopolitical risk premium could sporadically boost safe haven appeal of the USD.

As such, we expect residual pressure on rupee to persist, albeit to a mild degree. Our fundamental view on USDINR is guided by our call of USD 130 bn deficit on India’s current account deficit in FY23, accompanied by USD 50 bn deficit on Balance of Payments (i.e., current account deficit adjusted for total net capital inflows).

INR poised for its first monthly gain in 2022

Website: https://www.quanteco.in/