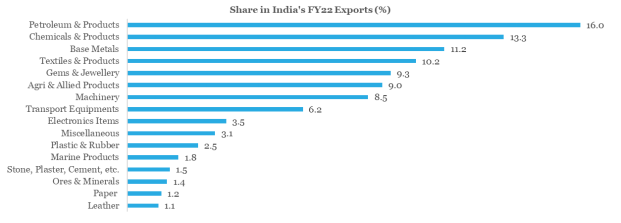

Category wise share of exports is a function of prevailing price and quantity demanded. Four key product categories, viz. Petroleum, Chemicals, Base Metals, and Textiles constituted ~51% of India’s exports in 2021-22.

Top 4 Categories have a share of ~51% in India’s export basket

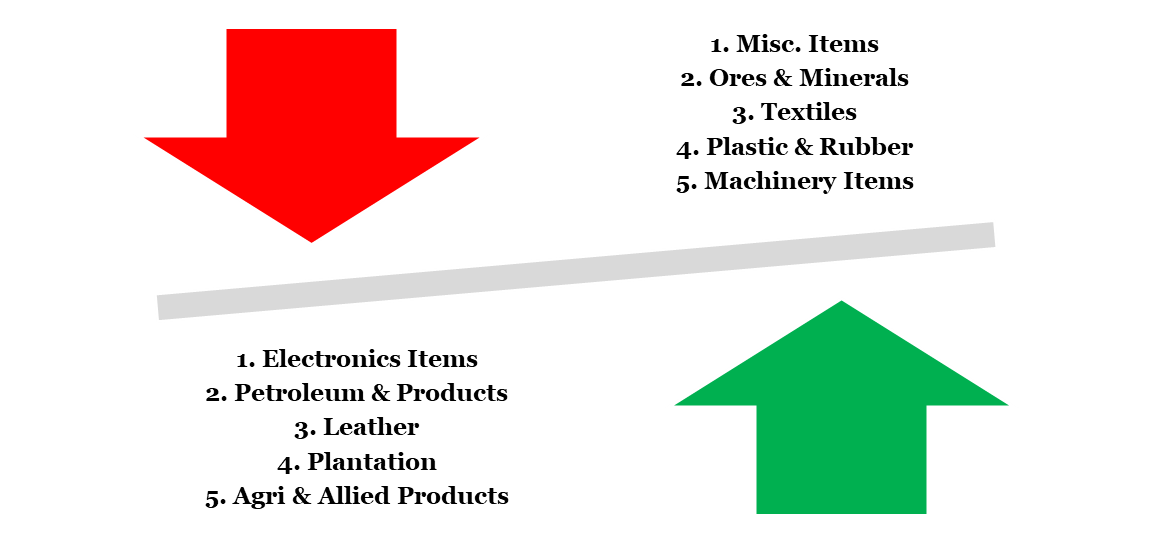

Share in export basket does not dictate performance or growth, which among others is a function of changes in macro environment, competitiveness, quality, and policy support. In 2022-23 so far (Apr-Nov), the Top 5 winners and losers from growth perspective are illustrated below.

Top 5 and Bottom 5 commodity exports (basis YoY growth over Apr-Nov 2022-23)

Electronics has been a massive outperformer this year with 54.4% YoY growth over Apr-Nov period. The sector has benefitted from the Atmanirbhar policy thrust, with PLI (Performance Linked Incentives) Scheme acting as a differentiator amidst the geopolitical backdrop of key manufacturers opting for supply chain diversification (via ‘China+1’ strategy, Onshoring, Friend Shoring, etc.).

As per our estimates, discretionary items1 had a share of ~32% in India’s exports (excluding defence) in 2021-22. With World GDP expected to see a sharp slowdown in 20232 on account of accelerated tightening of interest rates and persistence of geopolitical uncertainty, demand for discretionary exports (like electronics, leather, textiles, etc.) could face severe challenges.

Central banks: Rate hikes continue despite step down in monetary policy aggression

Amidst deceleration in inflation from peak levels, most key central banks have moderated the pace of rate hikes in last 1-2 months. While monetary tightening continues across the globe, there are now subtle differences emerging.

- The US Federal Reserve moderated its pace of rate hike to 50 bps in Dec-22 policy review from 75 bps in previous four occasions. However, Fed’s projection of the terminal fed funds rate, i.e., peak monetary policy rate in the current cycle has now moved up to 5.00-5.25% (to be achieved by Mar-23) from 4.50-4.75% in Sep-22. In addition, the Fed has projected rates to remain unchanged thereafter in 2023 – in contrast to market expectation of at least one round of 25 bps rate cut before the end of 2023.

- The Bank of England moderated its pace of rate hike to 50 bps in Dec-22 policy review from 75 bps earlier. The voting pattern appears mildly dovish (with 2 out of 9 members voting for no hike).

- Back home, the RBI too moderated its pace of rate hike to 35 bps from 50 bps in previous three occasions. Like BoE, the voting pattern shows a mild tilt towards dovishness (1 member voted for no change in rates, while 1 is likely to have voted for a neutral policy stance).

- While the European Central Bank too moderated its pace of rate hike to 50 bps in Dec-22 policy review from 75 bps in previous two occasions, the accompanying policy commentary was hawkish complemented by the announcement of the beginning of quantitative tightening3.

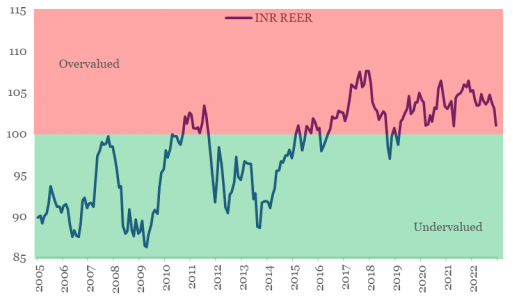

INR: Correction in overvaluation4

_______________________________________________________________

1: Discretionary items exclude plantation products, industrial products, specialized products, and crude oil from total export basket

2: As per the IMF, World GDP growth is projected to slow down to 2.7% from an estimated level of 3.2% in 2022.

3: Quantitative tightening refers to the selling of securities by the central bank to curb domestic liquidity

4: Real Effective Exchange Rate is used as one of the theoretical indices to judge domestic currency’s valuation vis-à-vis its trading partners. The index is adjusted for inflation differentials with trading partners. By virtue of construction, 100 is considered as the fair value for the domestic currency, with higher values signifying overvaluation, and vice versa

We believe US Fed’s ‘higher for longer’ monetary tightness is likely to provide a key source of support to the dollar. In addition:

- Going into 2023, the Fed will reduce its balance sheet by a further USD 1.1 trillion, way ahead of any other major central bank. This reduction of global dollar liquidity would continue to support the USD and cause INR to depreciate against the Dollar.

- Build-up of recessionary risks in Europe and elevated geopolitical risk premium could sporadically boost safe haven appeal of the USD and cause volatility in INR.

Notwithstanding our expectation of a sturdy USD, the recent softness has provided an opportunity to the RBI to shore up some of its lost foreign exchange reserves during Apr-Oct FY23. India’s FCA (Foreign Currency Assets) has risen by USD 26 bn since end Oct-22. With RBI’s active dollar purchases being one of the reasons behind recent increase in India’s foreign exchange reserves, INR has not been able participate in the rally in global currency market vis-à-vis the USD.

On the contrary, INR has weakened against 34 out 40 currencies (used by the RBI to compute rupee’s real effective exchange rate) in Dec-22 so far. This underperformance is helping to correct INR’s overvaluation. As per our estimates, the REER for rupee has moved lower from 103.1 in Nov-22 to close to 101.0, its lowest levels in last 20-months. An orderly correction of overvaluation in rupee is welcome as it helps in improving export competitiveness in the medium term.

Rupee’s overvaluation has seen a correction in last 2-months

Our fundamental view of 84 on USDINR by Jun-23 continues to remain unchanged. US Fed’s indication of ‘higher for longer’ monetary policy rate, RBI’s penchant for opportunistic reserve accumulation, and our Balance of Payments (i.e., current account deficit adjusted for total net capital inflows) call of USD 50 bn deficit would continue to drive mild weakness in rupee.

What should the Exporters Do ?

- Look at diversifying new orders away from Developed economies – US, EU etc. where due to high interest rates, clearly there is going to be a drop in discretionary spend. Middle East esp. Saudi Arabia, UAE etc. seem to be performing quite well. South East Asia overall seems to be impacted far lesser as compared to western economies due to ongoing adverse macro-economic developments.

- Ensure necessary due diligence on Buyers with relevant financial creditworthiness checks given the uncertain times, we are witnessing delay in shipment schedules across retailers with request to suppliers to hold back shipments post production even for confirmed orders. Working with Factoring companies for exports mitigates the buyer non-payment risk.

Website: https://www.quanteco.in/