The month of Feb-23 started with the presentation of the interim budget for 2024-25. We parse through the signals to look at key takeaways along with implication of exporters. This is followed by a quick assessment of US and India’s monetary policy along with the outlook on the Indian rupee.

1. FY25 Interim Budget prioritizes fiscal consolidation

The central government presented the 2024-25 interim budget (this will be superseded by the normal budget post the new government formation in Jun/Jul 2024) on Feb 1st, 2024. Although this was a vote-on-account, the Finance Minister clearly emphasized on the policy priority of maintaining macroeconomic soundness via two primary avenues:

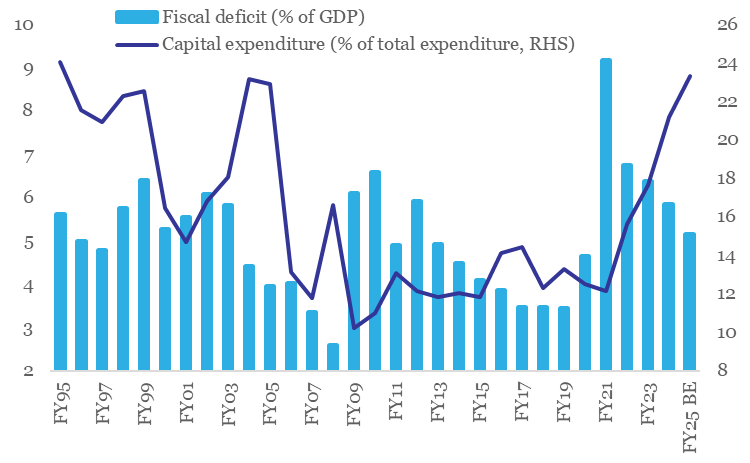

- Accelerating the process of fiscal consolidation

- After revising lower the fiscal deficit target for 2023-24 to 5.8% of GDP from 5.9% earlier, the interim budget consolidated further, with target for fiscal deficit budgeted at 5.1% of GDP for 2024-25, lower than market expectation of 5.2-5.4%.

- Prioritization of capital expenditure

- Allocation for capital expenditure is set to increase to a 20-year high of 3.4% of GDP in 2024-25 vis-à-vis 3.2% in 2023-24. Bulk of the capex allocation in 2024-25 will be geared towards the transport (esp. roads and railways) and defence sectors.

Chart 1: While fiscal deficit is set to reach its post pandemic low in 2024-25, allocation for capex is set to create a record multi-decade high

Source: Budget documents, CEIC, QuantEco Research

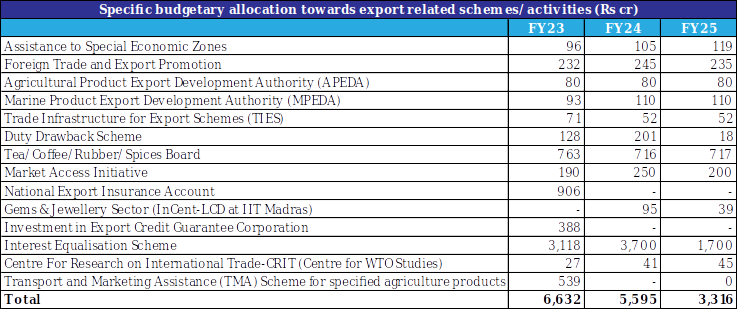

While that’s comforting from the perspective of overall macro stability and investor confidence, specific allocation towards external trade (under the Department of Commerce) saw a sizeable pruning.

- Specific trade related expenditure is set to contract by 41% in 2024-25 after witnessing a 16% contraction in 2023-24

- Bulk of the contraction budgeted in 2024-25 is an account of lower allocation for Interest Equalisation and Duty Drawback Schemes

- Notwithstanding the headline contraction, allocation for Assistance to Special Economic Zones and towards WTO activities are budgeted for a moderate expansion.

Table 1: Specific trade related budgetary allocation to get pruned in 2024-25

Source: Budget documents, QuantEco Research

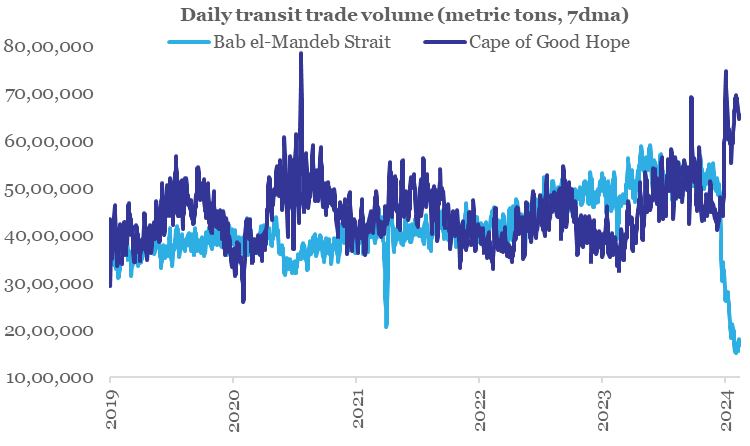

The sharp cut in the budgetary expenditure for the Department of Commerce in 2024-25 is not surprising as it accounts for the expiry of the Interest Equalisation Scheme after Jun-24. We do not believe this to have a material repercussion as recent steps taken by the government for export promotion are still playing out (for e.g., The Foreign Trade Policy, TIES/ MAI/ RoDTEP Schemes, Common Digital Platform for Certificate of Origin, facilitation of Districts as Export Hubs, promotion of e-commerce exports, etc.). Nevertheless, if some support is warranted on account of ongoing geopolitical disruptions (persistence of Red Sea disturbance could increase cost for exporters), the government could then look at extending the same in the upcoming normal budget in Jun/Jul 2024. Alternatively, with the Foreign Trade Policy now becoming dynamic, an addendum could get included to partially mitigate the adverse cost impact of geopolitical disruptions.

Chart 3: Global merchandise trade could potentially see a mild adverse impact due to disturbance in the Red Sea route

Source: IMF PortWatch, QuantEco Research

Note: The Red Sea region is a systemically important shipping lane that facilitates about 11% of global maritime trade. The key chokepoint lies around the Bab el-Mandeb Strait area, which in turn is connected to the Suez Canal, and is an important conduit for global maritime trade, connecting regions like Asia, Middle East, West & North Africa, Europe, and US East Coast. Most vessels are currently avoiding the Bab el-Mandeb Strait and opting for the longer route via the Cape of Good Hope.

2. Outlook on monetary policy

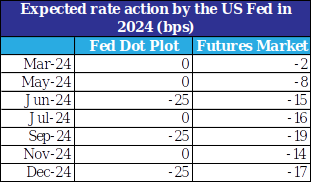

After maintaining a pause for four consecutive monetary policy reviews between Sep-23 and Jan-24 2023, the US Federal Reserve is once again expected to maintain the fed funds rate range unchanged at 5.25-5.50% in its forthcoming policy review meeting on Mar 20, 2024.

In the month of Jan-24, market participants were expecting the Fed to deliver cumulative rate cut of 125-150 bps from the Fed in 2024. We had highlighted that this seemed aggressive given residual inflationary pressures in the US economy, which has been witnessing a slower than anticipated loss of growth momentum.

Since then, the reversal of the rate tightening cycle by the Fed has got priced out, with market participants now expecting the first rate cut in Jun-24 vs. Mar-24 earlier. With this, the cumulative Fed rate cut expectation by market participants for 2024 currently stands adjusted at 75-100 bps. We believe the pricing now appears somewhat reasonable and investors should start positioning for the easing of US rate cycle from mid-2024 onwards.

With this as a backdrop, other key central banks could also begin their rate easing cycle with a lag. In case of India, as CPI inflation starts providing durable comfort in the coming quarters, we expect the RBI to start cutting repo rate from Oct-24 onwards with scope for up to 75 bps cumulative rate cut by Mar-25.

Table 2: Market expectation for rate easing is getting aligned with Fed member’s projections

Source: Federal Reserve, Refinitiv, QuantEco Research

Note: Fed Dot Plot reflects the median expectation of rate cuts by Fed members (as of Dec-23)

3. Rupee view

After facing persistent, albeit mild depreciation pressure over five consecutive months, INR is finally trying to recoup some of its losses. It appreciated by 0.2% each in Dec-23 and Jan-24 (closing the month at 83.04) and has gained another 0.1% in the month of Feb-24 so far (currently trading close to 82.97 levels).

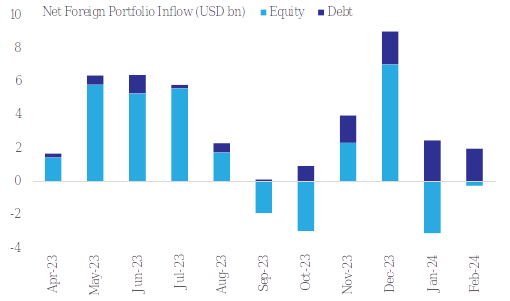

- We continue to believe that INR could remain supportive in Q4 FY24 on account of favorable year-end seasonality and market positioning ahead of India’s inclusion in JPM EM bond index (from Jun-24). In the last 5-months, India has received net foreign portfolio debt inflow of USD 9 bn, exceeding equity inflow of USD 2.9 bn.

- While global geopolitical risk and domestic election related uncertainties remain on the table, the tail risks have reduced significantly amidst range-bound movement in commodity prices and the state elections that on aggregate basis went in favor of the incumbent BJP government at the centre.

Although the factors for a mild near-term appreciation in INR remain in place, we believe it is unlikely to result in a durable trend due to RBI’s active intervention in the FX market (during Sep-Dec 2023, the central bank cumulatively bought and sold record high amount of USD 131 bn and USD 133 bn on gross basis respectively, even as the cumulative net intervention was at a paltry USD 1.7 bn of sold position).

Overall, we maintain our USDINR call of 82.5 by Mar-24 and 84.5-85.0 by Mar-25.

Chart 4: Post the announcement of India’s inclusion in JPM EM Bond Index in Sep-23, foreign debt inflow has picked up pace

Source: CEIC, QuantEco Research

Note: Data for February is till 21st

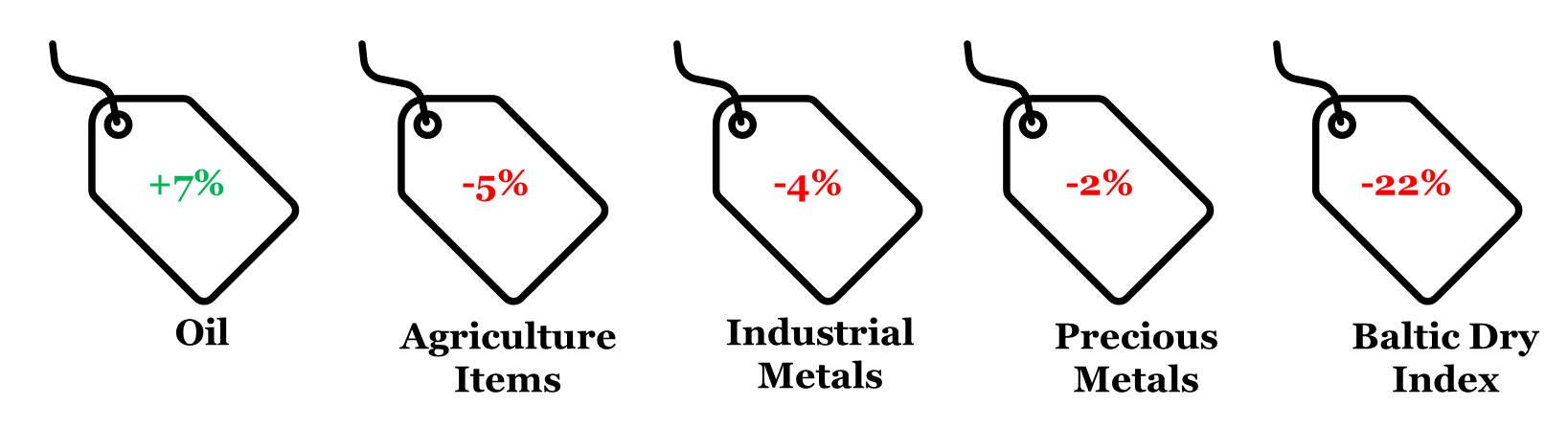

4. CYTD price change in key commodity groups and shipping cost

Note: (i) Price change is between Feb 20, 2024 and Dec 31, 2023; (ii) Oil price is represented by Brent; (iii) Agriculture Items, Industrial Metals, and Precious Metals are represented by respective Bloomberg Commodity indices; (iv) rounded off figures represented.

Data: Refinitiv, QuantEco Research