Even as the Israel-Hamas war continues to simmer, tail risks for global trade have not yet acquired baseline characteristics. In this issue we highlight the emergence of a silver lining for global and Indian trade, while remaining cautious of the impending wave of slowdown. This is followed by a quick assessment of US monetary policy along with the outlook on Indian rupee.

1. Global merchandise trade: Dark clouds with silver lining

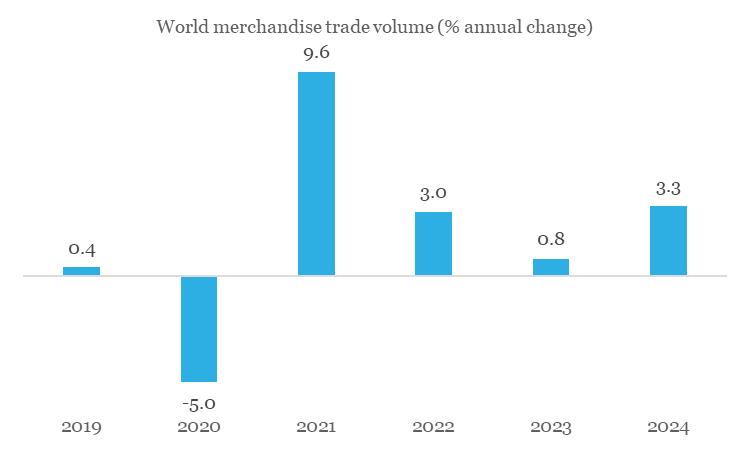

The World Trade Organization downgraded its forecast for growth in volume of world merchandise trade in 2023 to 0.8% vis-à-vis its earlier estimate of 1.7% in Apr-23. Slowdown in merchandise trade appears to be broad-based, involving many countries and a wide array of goods, esp. “certain categories of manufactures such as iron and steel, office and telecom equipment, textiles, and clothing”. A notable exception is passenger vehicle segment, sales of which have surged in 2023 so far. It appears that high inflation, tight monetary policy, dollar strength, and persistent geopolitical tensions have weighed upon global trade sentiment.

Chart 1: The WTO outlines a sombre near-term outlook for global trade

Source: WTO, QuantEco Research

While the forecast for 2023 appears sombre, there is a silver lining too:

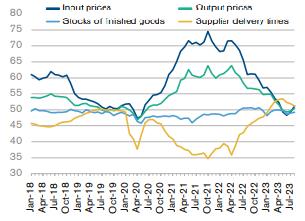

- Global supply chains have now reverted to their baseline values that existed prior to the pandemic. This suggests that supply conditions have normalised after pandemic-related disruptions over the last three years. Falling input and output prices also suggest that global inflationary pressures are waning.

- WTO’s forecast for 2024 offers hope of recovery in global trade. If the forecast for 2024 is realised, then “Asia would be the fastest growing region on both the export and import sides”.

Chart 2: Global supply chain conditions have normalized after the pandemic related disruptions

Source: WTO, QuantEco Research

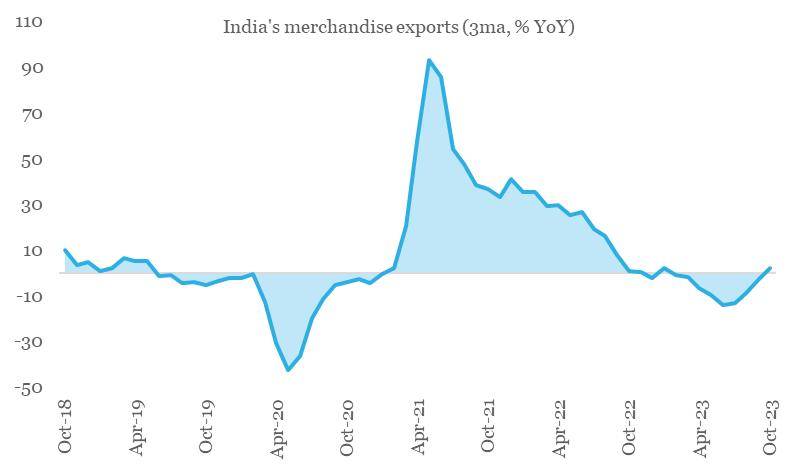

From India’s export perspective, we see this translating into tapering of contractionary pressure. On 3-month rolling basis, India’s merchandise exports grew by 2.3% YoY in Oct-23, marking its first expansion in 9-months.

Chart 3: India’s merchandise exports are showing early signs of expansion

Source: CEIC, QuantEco Research

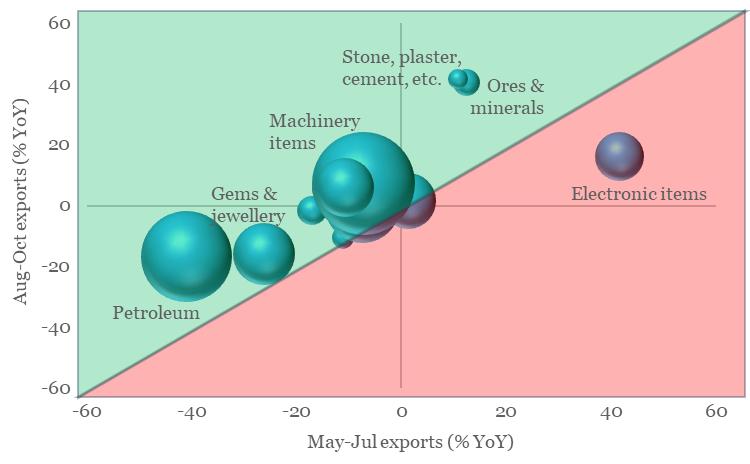

The expansion in Oct-23 appears nearly broad-based. Barring plantation products and electronic items, all other subcategories of merchandise exports have shown an improvement in momentum on 3-month average basis. Improvement in last 3-months has been led by (i) Stone, plaster, cement, etc., (ii) Ores & minerals, (iii) Petroleum products, (iv) Marine products, (v) Textiles, (vi) Plastic & rubber items, (vii) Machinery items, and (viii) Gems & jewellery.

Chart 2: Recent improvement in India’s export momentum appears almost broad-based

Note: Size of the bubble corresponds to respective share in FY23 merchandise exports

Source: CEIC, QuantEco Research

2. Outlook on monetary policy

Along expected lines, the US Fed maintained status quo on policy rates at its Nov-23 policy review. For the first time in the current tightening cycle, the FOMC skipped hiking policy rate for two consecutive meetings. Although the Fed has retained flexibility to hike one more time, recent incoming economic data from the US suggests a softening bias on both activity and prices front.

Market participants are currently attaching a peak rate hike probability of just ~14% in the Jan-24 policy review. Thereafter, market participants are attaching a rate cut probability of ~66% for Jun-24 policy review.

We concur with the consensus view and continue to expect a turn in the US monetary policy cycle by mid-2024. This should allow other central banks to follow suit, with RBI likely to opt for its first rate cut in Q2 FY25.

3. Rupee view

In line with our expectations, INR continues to trade close to its record low levels vs. the USD, accompanied by subdued volatility. Factors weighing upon INR from near term perspective:

- India’s monthly merchandise trade deficit touched a record high level of USD 31.5 bn in Oct-23.

- Foreign investment flows (both FDI and FPI) have been subdued in recent months, possibly on account of uncertainty on US rate trajectory and elevated geopolitical risks.

While this could push INR towards a fresh all-time low of close to 84 levels (vs. the USD) by Dec-23, we note that pressure for further weakness in INR could no longer be binding in the coming weeks.

Emergence of signs of softening in US economy coupled with contained impact (so far) of Israel-Hamas war bodes well for a reversal in the INR trajectory. In the absence of fresh escalation of geopolitical risks, we continue to expect INR to partially reclaim lost ground and move towards 82 levels in Mar-24 amidst favorable Q4 seasonality and anticipated USD weakness as market participants position for a pivot in US monetary policy cycle by mid-2024.

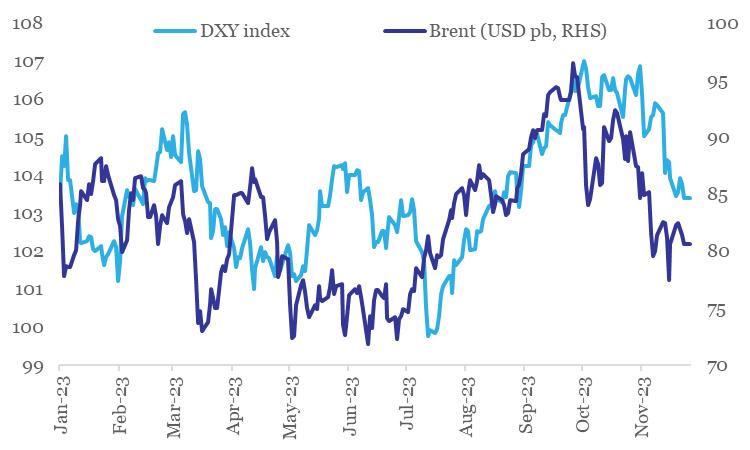

Chart 4: Dollar and crude oil have corrected sharply in last 1-month

Data: Refinitiv, QuantEco Research

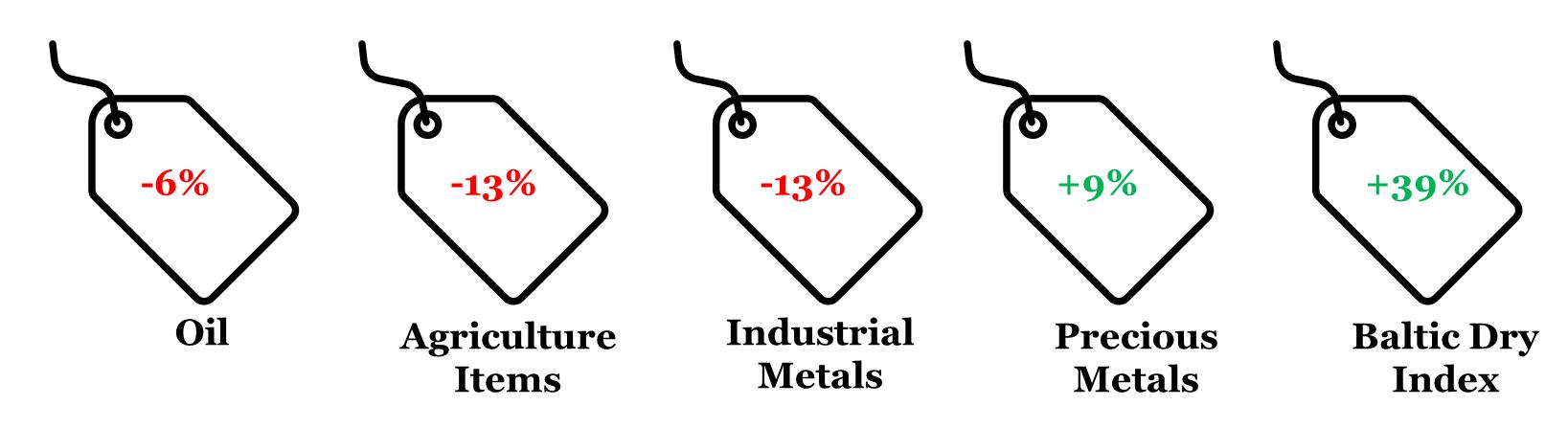

4. CYTD price change in key commodity groups and shipping cost

Note: (i) Price change is between Nov-23 and Dec-22; (ii) Oil price is represented by Brent; (iii) Agriculture Items, Industrial Metals, and Precious Metals are represented by respective Bloomberg Commodity indices; (iv) rounded off figures represented.

Data: Refinitiv, QuantEco Research