In this month, we take stock of the performance of global merchandise trade in 2024 along with India’s relative position. Global trade faces considerable uncertainty from the likelihood of another US led tariff war in 2025. We also undertake a quick assessment of US and India’s monetary policy along with the outlook on the Indian rupee.

1. Round-up of global trade performance in 2024

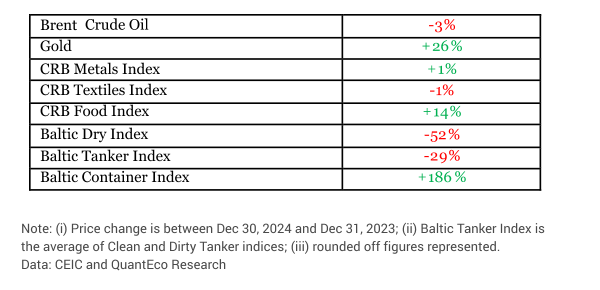

Global merchandise trade staged a recovery in the calendar year 2024, with growth in exports outpacing imports.

· As per our estimates, the value of global merchandise exports clocked an expansion of 2.2% between Jan-Nov 2024 compared to a contraction of 3.4% seen in the corresponding period in 2023.

o India’s merchandise exports depicted a broadly similar outturn, i.e., after contracting by 5.3% between Jan-Nov 2023, clocked a moderate recovery, expanding by 3.0% between Jan-Nov 2024.

· The value of global merchandise imports clocked a mild expansion of 1.7% between Jan-Nov 2024 compared to a contraction of 5.6% seen in the corresponding period in 2023.

o India’s merchandise imports depicted a broadly similar outturn, i.e., after contracting by 6.4% between Jan-Nov 2023, showed a moderate recovery, expanding by 6.8% between Jan-Nov 2024.

This is broadly consistent with the estimates provided by the WTO – the multilateral body had projected world merchandise trade volume to expand by 2.7% in 2024 vs. an estimated contraction of 1.1% in 2023. Notwithstanding the persistence of geopolitical uncertainties, efforts by central banks in several countries to start unwinding policy tightness appears to have provided a supportive backdrop.

From India’s perspective, we note that while it’s estimated share in global merchandise exports stood unchanged at 1.7% in 2024 (same as in 2023), it’s share in global merchandise imports increased to a fresh all-time high of 3.0% in 2024 (vs. 2.9% in 2023).

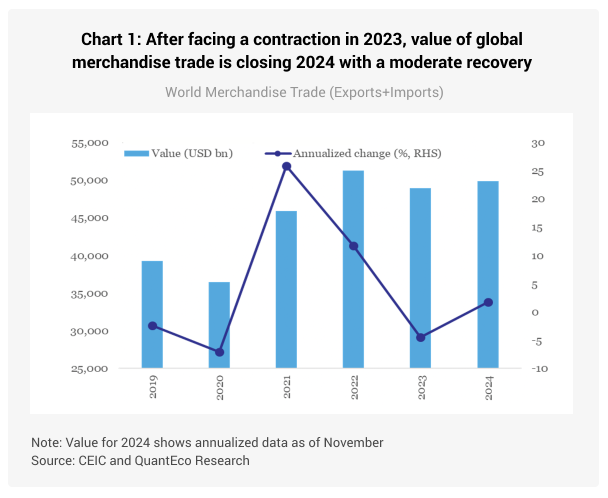

While record high price of precious metals may partly explain the bulge in India’s merchandise imports in 2024, we believe there is scope for improvement in India’s export performance. For example, the chart below illustrates the difference between the growth in individual country’s headline merchandise import vis-à-vis its import from India. Although the framework is simplistic and ignores the role of geopolitical, operational (like trade costs etc.), and structural factors (role of comparative advantage, etc.), it nevertheless shows the gap between the potential scope and actual performance for destination of India’s exports.

2. The incoming global trade uncertainty

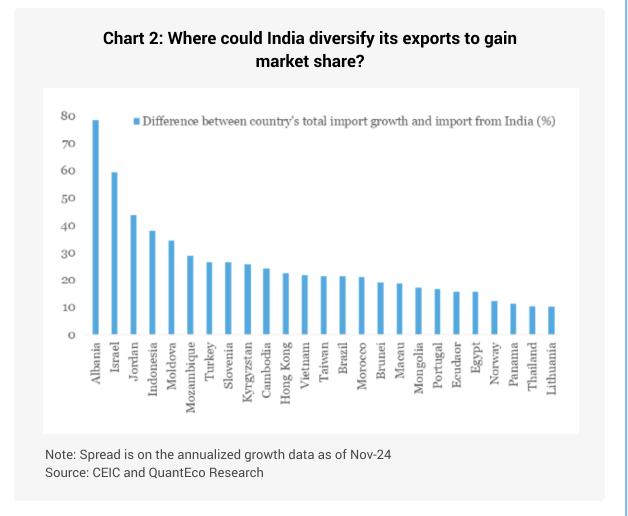

Donald Trump, who emerged victorious in the recently concluded US presidential elections, will start his second term at the oval office from Jan-25. Unlike the previous term, the

incoming term will see greater majority for Republicans in the Senate as well as the House, thereby providing better policy manoeuvrability. President-elect Trump is widely known for using tariffs as tool for international negotiations. He has promised that under his administration, the US would impose a universal tariff of 10% on all major trading partners, along with a higher rate of tariff of 25-60% for countries like Mexico, Canada, and China.

As per the Peterson Institute for International Economics, if tariffs are levied on all US trade partners as well as China, large flows of machinery, electronics, transportation equipment, and chemicals will be subject to new taxes, with much of the burden falling on US-based businesses. Consumers, however, will also see higher costs for imported final goods, including electrical devices, toys and sporting goods, vegetable and meat products, and imported foodstuffs.

While there is heightened macro uncertainty on the prospects of global trade for 2025, there is also considerable micro uncertainty on the implementation of proposed tariffs by the incoming US administration. It is unclear if the proposed tariffs would have a list of exempted products, or whether the FTA partners would receive a preferential treatment. There is also a high possibility of retaliation from US trade partners as the proposed tariffs by the US administration could violate WTO and FTA commitments. The likely retaliation could take many forms, ranging from reciprocal tariffs to imposition of non-tariff measures, and incorporating currency adjustments.

Last but not the least, any widespread use of tariffs could also face resistance from domestic manufacturers in the US, some of whom would be reliant upon global value chains for inputs. Hence, it remains to seen how the incoming administration balances economic pragmatism vs. election rhetoric.

3. India’s FYTD export performance

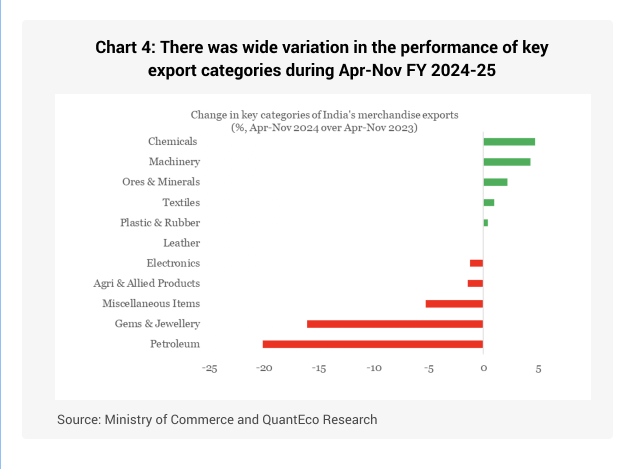

As per preliminary estimates from the Ministry of Commerce, India’s merchandise exports grew at a moderate rate of 2.2% to USD 284 bn during Apr-Nov FY 2024-25 from USD 278 bn in the corresponding period in FY 2023-24. At a granular level:

· Top 5 items that recorded the fastest growth were Coffee, Tobacco, Electronic goods, Plastic and linoleum, and Tea.

· Bottom 5 items in terms of growth were Miscellaneous cereals, Iron ore, Petroleum products, Oil meals, and Gems and jewellery.

· The annualized share of Electronic items in India’s export basket currently stands at its highest level of 7.7%.

· The annualized share of Gems and jewellery items in India’s export basket currently stands at its lowest level of 6.9%.

4. Monetary Policy: US Fed at a crossroad

After decisively cutting fed funds rate by a cumulative of 100 bps between Sep-Dec 2024, the US Federal Reserve now finds itself at crossroads. The eagerness to lower the monetary policy rate is now facing resistance from US economic resilience. More importantly, the likely imposition of tariffs by the incoming US administration under the leadership of Trump poses the risk of fanning inflationary pressures.

This has resulted in the US Fed members scaling back their projected rate cut expectations by 50 bps for 2025 (the Fed now projects room for a cumulative 50 bps rate cut in 2025 vs. its earlier forecast of 100 bps cut in 2025). Post the presidential election outcome, market participants have also pared their expectation of the likely dose of US rate cuts – current interest rate futures pricing suggest the likelihood of 25-50 bps rate cut through the course of 2025.

In case of India, the RBI shifted its monetary policy stance to ‘neutral’ from ‘withdrawal of accommodation’ in its Oct-24 policy review and followed it up with a 50 bps CRR cut in the Dec-24 policy review. While the shift in monetary policy stance happened without any change in the monetary policy rate (repo rate continues to remain at 6.50%), we believe it is a precursor for easing of interest rates in the near future. Depending upon the anticipated correction in domestic food prices and its overall impact on CPI inflation, market participants expect the RBI to deliver its first rate cut in Feb-25 policy review. However, the likelihood of

lower degree of monetary easing from the US Fed in 2025 could have some spillover impact on EM central banks.

5. Rupee view

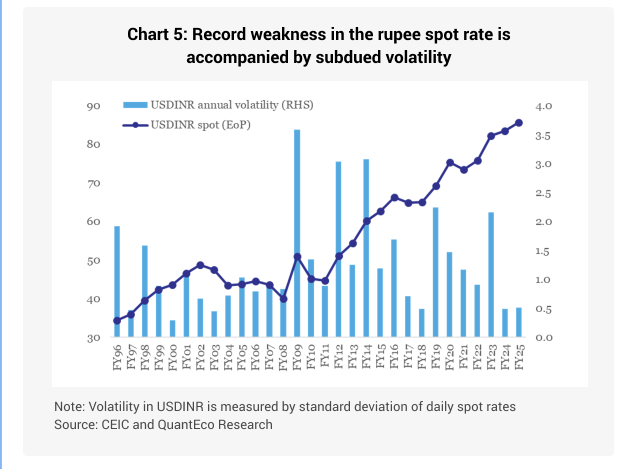

The Indian rupee touched a record low as it breached the 85.5 level against the US dollar in Dec-24. The depreciation pressures are a culmination of the following factors:

· Broad based strength in the US dollar on account of a relatively better economic position of US vis-à-vis its peers

· Elevated geopolitical tensions in the Middle East and uncertainty on the prospects of global trade (esp. in the backdrop of upcoming US presidential election in Nov-24) have supported the safe haven demand for the dollar.

· Meanwhile co-ordinated policy easing in China along with the target of Trump’s renewed tariff war is resulting in weakness in the Chinese yuan, which in turn is putting pressure on emerging market currencies.

· Foreign investment inflows into India have moderated on account of heightened geopolitical geoeconomic uncertainties.

o Net FDI inflow has dropped to USD 2.1 bn during Apr-Oct FY 2024-25 from USD 7.7 bn in the corresponding period in FY 2023-24.

o Net FPI inflow has moderated to USD 10.9 bn during Apr-Dec FY 2024-25 from USD 31.7 bn in the corresponding period in FY 2023-24

· Basis the RBI’s Real Effective Exchange Rate index (a trade weighted average exchange rate that adjusts for inflation differentials with the trading partner), the rupee is ~10% overvalued compared to the long period average. As such, any depreciation in the currency helps to correct for the inherent overvaluation.

Amidst an uncertain backdrop, it now appears that the USDINR could now face lower resistance in moving towards 86.0 levels by Mar-25

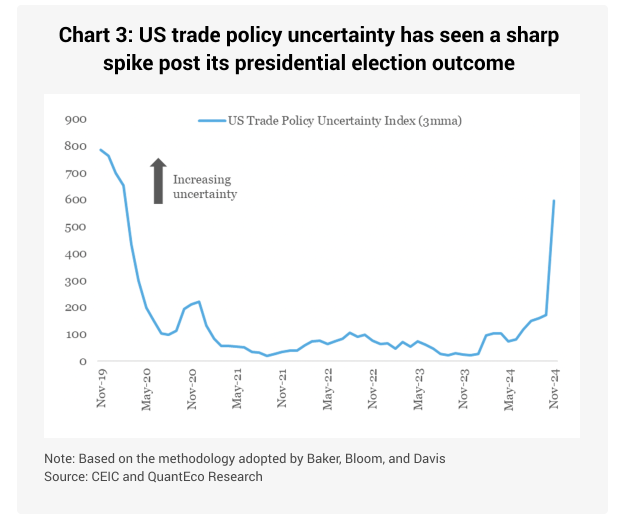

5. CYTD price change in key commodity groups and shipping cost