The calendar year 2025 has started on a cautionary note as far as global trade is concerned. The new US administration is prioritizing protectionism over sound economic wisdom. This could lead to a reset in the global trade order, with the burden of adjustment on rest of the world, at least in the near term. Meanwhile, India seems to be treading a cautious and calculated path, with focus on domestic macroeconomic stability along with openness for laying the groundwork for a strategic trade agreement with the US. On the domestic front, the government presented the Union Budget for 2025-26. We parse through the signals to look at key takeaways along with implication for exporters. This is followed by a quick assessment of US and India’s monetary policy along with the outlook on the Indian rupee.

1. Union Budget 2025-26: Focuses on macro-stability

The central government presented its annual budget for 2025-26 on Feb 1st. At a broad macro level, the fiscal policy has provided five important signals:

· Progress on fiscal consolidation: At the outset, the Finance Minister revised lower the fiscal deficit target for 2024-25 to 4.8% of GDP from 4.9% budgeted earlier. For 2025-26, the budget will continue to prioritize consolidation, with lowering of fiscal deficit target to 4.4% of GDP, the lowest in the post-COVID phase.

· Pre-emptive move on tariff rationalization: With the US announcing that it will impose reciprocal tariffs on its trade partners from Apr-25 onwards, the 2025-26 Union Budget has opted for rationalization of the tariff structure. The basic customs duty on as many as 30 items that covers luxury vehicles, chemicals, solar cells, and machinery will be lowered along with a mark down in the peak import tariff from 150% currently to 70%, resulting in the average tariff rate falling to around 11% from 13% currently.

· Mini consumption stimulus: Rates and slabs for personal income tax will be changed from 2025-26 to raise the ‘nil tax’ slab to Rs 12.75 lakhs pa (with standard deduction) from Rs 7 lakh pa currently. This is expected to benefit approximately 3 cr middle-class taxpayer and could potentially provide up to 30 bps impetus to GDP growth in 2025-26 as per our estimates.

· Continued focus on capital expenditure: Allocation for capital expenditure is set to remain high at 3.1% of GDP in 2025-26. Bulk of the central government’s capex allocation in 2025-26 (~62%) will be geared towards the transport (esp. roads and railways) and defence sectors.

From the perspective of MSMEs, the Union Budget for 2025-26 has few salient takeaways:

· The budgetary allocation for the Ministry of MSME will see ~34% hike in 2025-26 to Rs 23,168 cr.

· The investment and turnover limits for classification of MSMEs will be raised by 2.5x and 2.0x respectively.

· Financing to receive a boost from (i) enhancement of CGTMSE cover and Credit Guarantee, (ii) provision of customised credit cards for UDYAM registered enterprises, (iii) new scheme for term loans for 5 lakh first-time entrepreneurs, and (iv) revamping of the PM SVANidhi scheme.

· Labour intensive sectors (footwear, leather, and toys) will get new schemes in 2025-26; Government to position India as a global toy hub.

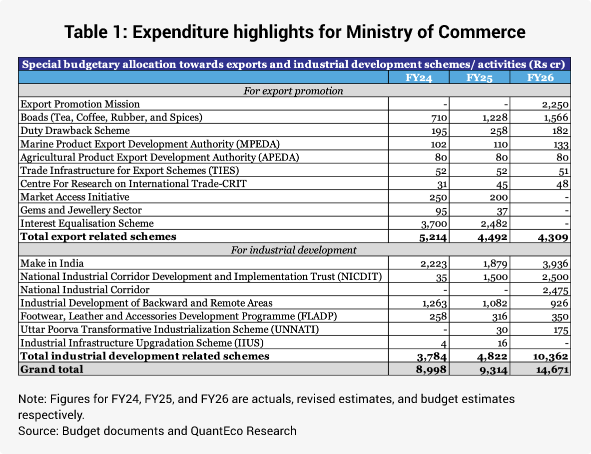

From the perspective of exporters, the Union Budget for 2025-26 has the following takeaways:

· Ministries of Commerce, MSME, and Finance will collaborate to set up an Export Promotion Mission to facilitate easy access to export credit, cross-border factoring support, and support to MSMEs to tackle non-tariff measures in overseas markets.

· A unified digital public infrastructure platform – Bharat Trade Net, will be set-up for streamlining all trade documentation and financing solutions. This will complement the Unified Logistics Interface Platform.

· Infrastructure and warehousing for air cargo including high value perishable horticulture produce will get be upgraded. Cargo screening and customs protocols will be streamlined and made user-friendly.

While that’s encouraging, specific allocation towards export promotion under the Ministry of Commerce will see a marginal decline to Rs 4309 cr in 2025-26 from Rs 4492 cr in 2024-25. This will primarily be on account of expiry of the Interest Equalisation Scheme. Having said, the commerce ministry is expected to raise its contribution towards promotion of domestic manufacturing via sharp increase in allocations for Make in India and National Industrial Corridor.

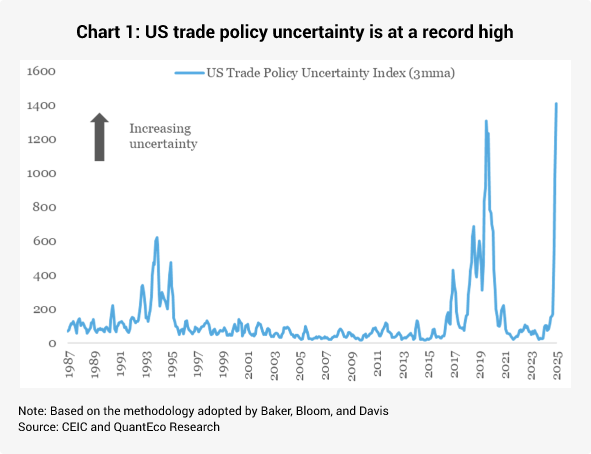

2. Trump tariff tantrums

The spectre of tariff related disruption to global merchandise trade appears more plausible than ever before. In less than one month of assuming office, US President Trump has caused tremors in the hitherto prevailing merchandise trade arrangements. The new administration has implemented 10% tariffs on all imports from China. A universal tariff of 25% on steel and aluminium has also been announced, while the announced 25% tariffs on all imports from Mexico and Canada is currently on pause until the end of Feb-25. The Trump administration has also announced its intent to impose reciprocal tariffs starting Apr-25, with coverage extending to all trading partners to achieve equalization of tariff rates with the US.

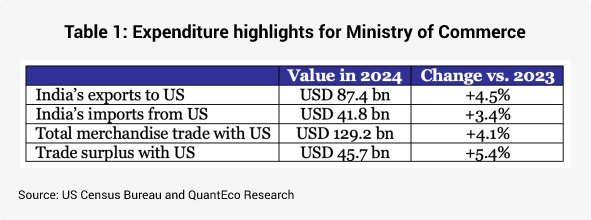

The imposition of reciprocal tariffs might have ramifications for the Indian economy – after all, US had a share of 17.7% in India’s merchandise exports, 6.2% in merchandise imports, and 10.7% in total merchandise trade, thereby making it India’s largest trade partner in 2023-24.

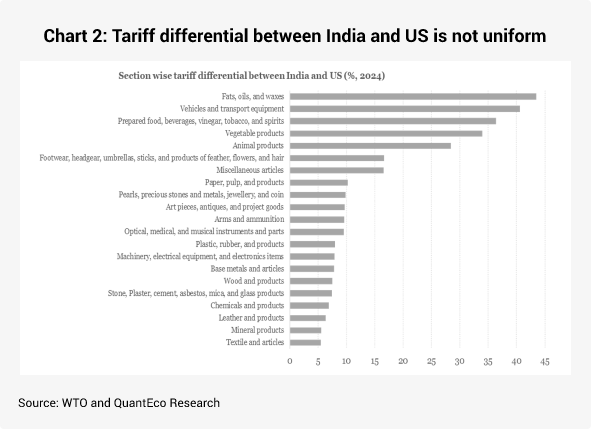

From US’s perspective, while India stood as the 10th largest merchandise trade partner in 2024, it had the highest rate of tariff (India imposes MFN rate of tariff on all countries with which it does not have an FTA). As of 2023, India’s trade weighted average MFN tariff stood at 12.0% vis-à-vis the corresponding rate of tariff imposed by US at 2.2%. This puts the tariff differential between India and US at 9.8% (as of 2023), one of the highest among major trading partners.

· The tariff differential between India and US is under 10 percentage point for 66% of goods

· Extremely high differential of more than 100 percentage point exists only in case of 0.5% of the goods

Hence, while India’s tariff rates are undoubtedly higher vis-à-vis the US, it is not uniform across the commodity items and appears to be rather on account of select items. For e.g., at a section wise level, the tariff differential is highest in case of animal and vegetables fats, oils and waxes at 43.5%, while the lowest differential is seen in case of textiles and products, at 5.5%.

Value in 2024 Change vs. 2023

India’s exports to US USD 87.4 bn +4.5%

India’s imports from US USD 41.8 bn +3.4%

Total merchandise trade with US USD 129.2 bn +4.1%

Trade surplus with US USD 45.7 bn +5.4%

As of now, it is not clear how the US administration is going to approach the notion of reciprocal tariffs. The implied tariff differential would change depending upon whether the US administration decides to focus on the country wise differential, sector wise differential, or item wise differential. A bigger uncertainty stems from the treatment of non-tariff measures. As per our estimates, in the last 15-years, US has imposed 3.9x more discriminatory non-tariff measures on India. In all appropriateness, the US administration needs to undertake a comprehensive assessment of both tariff and non-tariff measures before imposing reciprocal tariffs on India (or for that matter any other country).

India has already offered an olive branch to the US by pre-emptively pruning custom duties for select items in the Union Budget for 2025-26. As per media reports, India’s Ministry of Commerce is preparing a supplementary list of items which might see tariff rationalization in Mar-25, before reciprocal tariffs are set to be activated in Apr-25. More importantly, the recent visit by PM Modi to the US in Feb-25 appears encouraging.

· India and US have set a bilateral trade (including both goods and services) goal of USD 500 bn by 2030 vis-à-vis USD 195 bn in 2023.

· As a major step towards this journey, there is likely to be an announcement of a Bilateral Trade Agreement in the final quarter of 2025. To advance this innovative, wide-ranging BTA, the US and India will take an integrated approach to strengthen and deepen bilateral trade across the goods and services sector, and will work towards increasing market access, reducing tariff and non-tariff barriers, and deepening supply chain integration.

· India has agreed to increase trade share in the area of energy items, defense, and technology and innovation, besides strengthening multilateral cooperation and people-to-people connect.

On a separate note, India is attempting to diversify its trade engagements with other countries.

· India and Qatar are exploring the possibility of entering into a bilateral Comprehensive Economic Partnership Agreement, with the objective of doubling the bilateral trade by 2030.

· India-UK negotiations have got fast tracked to finalize the FTA.

· India and EU will review their FTA negotiations and finalize a strategic agenda during European Commission President’s visit in Mar-25. Upon finalization, this would become India’s largest ever FTA, granting improved market access for sectors such as textiles, leather, and marine products. The EU is India’s second-largest export market after the US.

3. Monetary Policy: US Fed at a crossroad

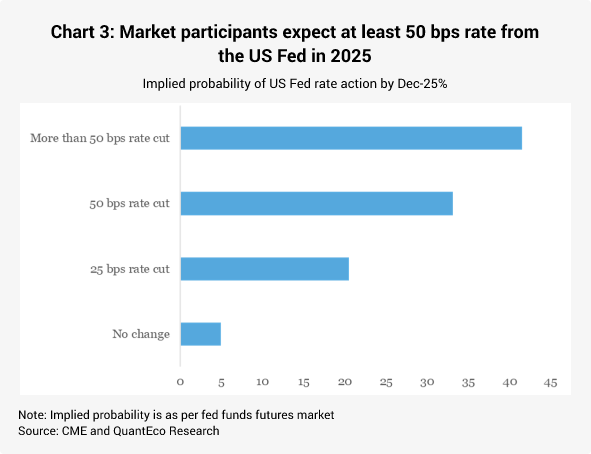

After decisively cutting fed funds rate by a cumulative of 100 bps between Sep-Dec 2024, the US Federal Reserve now finds itself at crossroads. The path towards lower interest rates is now facing resistance from US economic resilience and the likely pressure on US debt from Trump’s anticipated fiscal expansion. More importantly, the likely imposition of tariffs by the incoming US administration under the leadership of Trump poses the risk of fanning inflationary pressures.

This has resulted in the US Fed members scaling back their projected rate cut expectations by 50 bps for 2025 (the Fed now projects room for a cumulative 50 bps rate cut in 2025 vs. its earlier forecast of 100 bps cut in 2025).

In case of India, the RBI announced its first rate cut in five years, with a 25 bps cut in the repo rate (to 6.25%) at its Feb-25 policy review meet. Correction in food prices in the last three months helped in lowering CPI inflation from its recent peak of 6.21% in Oct-24 to 4.31% in Jan-25. We believe the benign trend in food inflation is likely to prevail in the near-term, thereby providing room to the RBI to undertake additional 25 bps rate cut in its next policy review in Apr-25. Having said, the likelihood of lower degree of monetary easing from the US Fed here on in 2025 along with relatively sharp pace of weakness in the Indian rupee in recent months could restrain the scope for monetary easing thereafter.

4. Rupee view

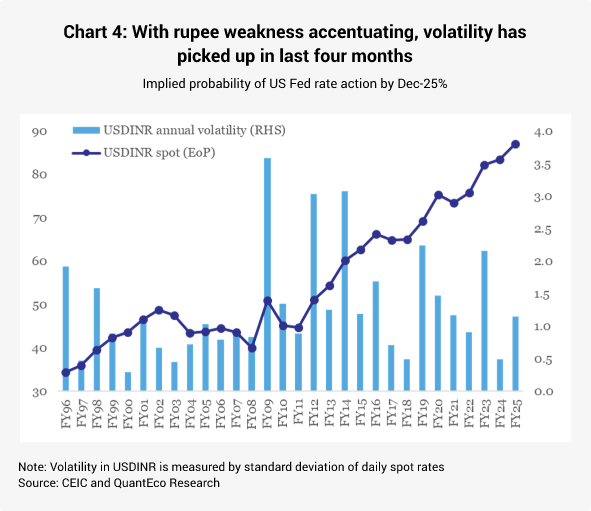

The Indian rupee started the calendar year 2025 on a sombre note by extending the weakness seen in the last quarter of 2024. Subdued sentiment for rupee continues to persist, with the

currency breaching the 87.5 level earlier in Feb-25. However, since then, the currency has a made a comeback, aided by RBI’s interventions.

As far as the RBI is concerned, there now appears to be a somewhat greater tolerance for INR flexibility. While prima facie it would be difficult to ascribe a cause for the change in the central bank’s reaction function towards exchange rate management, a gradual build-up in INR overvaluation over last 3-quarters, decline in RBI’s FX import cover due to sizeable intervention since Oct-24, and a need for currency adjustment in a new global trade order could be possible reasons towards the same.

We expect USDINR to trade close to 87.50 levels by Mar-25, while acknowledging that the near-term trajectory could potentially see above normal volatility on account of known-unknown risks. Going into next financial year, we expect USDINR to move towards 89.50, before Mar-26. Having said, upside risks to USDINR have strengthened post RBI’s greater tolerance for a weaker currency and more importantly due to heightened geopolitical and geoeconomic uncertainties.

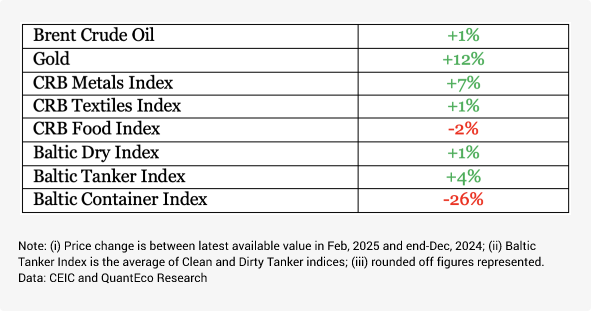

5. CYTD price change in key commodity groups and shipping cost