The month of July has turned out to be important from two perspectives. On the domestic front, the central government presented the final budget for FY25, superseding the interim budget presented earlier in Feb-24. We parse through the signals to look at key takeaways along with implication for exporters. Meanwhile, expectations of commencement of monetary easing cycle (by the Fed and the RBI) and the presidential election season in the US are getting charged up. We take a quick look at what this holds for the rupee.

1. FY25 Union Budget prioritizes fiscal consolidation with micro boosters

On Jul 23rd, the central government presented the final Union Budget for 2024-25, superseding the interim budget presented earlier in Feb-24. Since the NDA retained the office after the general election outcome, fiscal policy continuity was maintained. Key highlights:

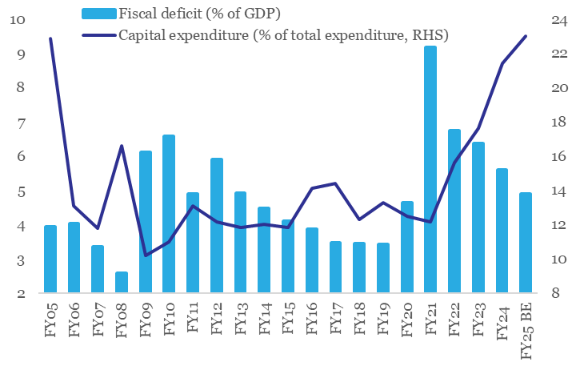

- Acceleration of fiscal consolidation

- The Finance Minister pruned the target for fiscal deficit to 4.9% of GDP from interim budget’s estimate of 5.1%. However, the incremental tightness in fiscal deficit will not be driven by pruning of expenditure. In fact, government’s expenditure bill is slated to increase to 14.8% of GDP, up from interim budget’s estimate of 14.6%. This has been possible on account of sharp increase in non-tax revenue with the RBI sharing record high dividend of Rs 2.1 lakh cr with the central government earlier this year.

- Prioritization of capital expenditure

- Allocation for capital expenditure is set to touch a 20-year high of 3.4% of GDP in 2024-25 vis-à-vis 3.2% in 2023-24. Bulk of the capex allocation in 2024-25 will be geared towards the transport (esp. roads and railways) and defence sectors.

Chart 1: While fiscal deficit is set to reach its post pandemic low in 2024-25, allocation for capex is set to create a record multi-decade high

Source: Budget documents, CEIC, QuantEco Research

While that’s comforting from the perspective of overall macro stability and investor confidence, there were specific micro-boosters in the budget for supporting growth in targeted sectors like MSMEs.

- Availability of credit

- The TARUN category of MUDRA loans will now see an enhanced limit of Rs 20 lakhs from Rs 10 lakhs earlier.

- A new credit guarantee scheme, backed by the central government will be launched that will offer a guaranteed coverage up to Rs 100 cr per applicant.

- To prevent MSME loans classified as SMA accounts by the banks, the government will provide additional credit support from a credit guarantee fund to prevent such loans from slipping into NPAs.

- Over the next 3-years, SIDBI has been mandated to open 24 new branches, extending its services to 168 of the 242 major MSME clusters.

- Public sector banks will now build in-house capability for assessment of MSME credit instead of relying on external assessment.

- Financial stability and ease of operations

- The turnover threshold for buyers on the TReDS (Trade Receivables Discounting System) platform will be reduced from Rs 500 cr to Rs 250 cr, allowing 22 additional PSUs (public sector undertakings) and 7000 more companies to join the platform.

- Building infrastructure ecosystem

- The government will establish E-Commerce Export Hubs through public-private partnerships (PPPs). These hubs will provide a range of trade and export-related services under one roof, enabling MSMEs and traditional artisans to market their products internationally.

- The budget will provide financial support for setting up 50 multi-product food irradiation units and creating 100 NABL-accredited laboratories for quality, and safety testing units.

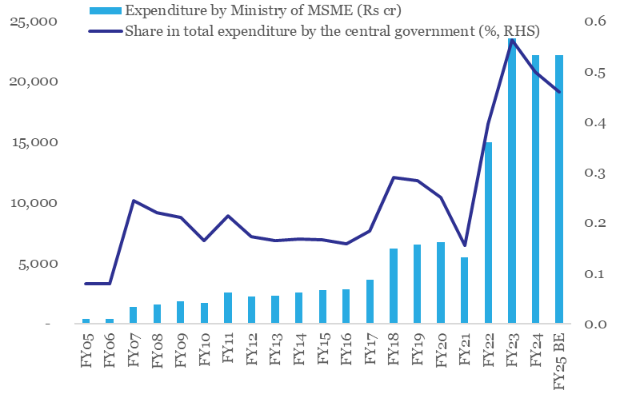

Chart 2: Although MSME ministry’s expenditure is set to moderate a tad, it remains significantly higher than its pre COVID levels

Source: Budget documents, CEIC, QuantEco Research

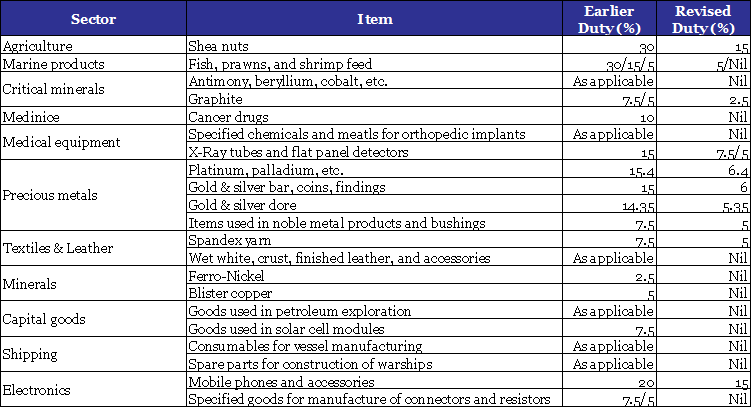

The measures outlined above will immensely benefit most exporters. In addition, the exporters would also gain from the announced reduction in custom duties (items illustrated in Table 1 below), that will help to boost cost competitiveness.

Table 1: Customs duty cuts in FY25 Union Budget will support domestic manufacturing, promote export competitiveness, and simplify taxation

Source: Budget documents, QuantEco Research

2. Monetary Policy: Moving closer to the beginning of the rate easing cycle

Along expected lines, the US Federal Reserve once again pushed back monetary easing expectations at its Jun-24 policy review. As per the latest projections by the Fed members, there is likely to be one rate cut before the end of 2024, down from the projection of two rate cuts predicted earlier in Mar-24.

However, with recent US economic data turning out to be softer than anticipated, market participants have priced in at least two rate cuts from the Fed (with the first cut in Sep-24) before the end of 2024. As such, the 1-year US Treasury bill rate has dropped by 30 bps since end Jun-24 to 4.79% currently.

In case of India, we believe the RBI will follow its own course and wait for food price volatility to subside after the completion of the 2024 south-west monsoon season (in which the Indian Meteorological Department projects a 6% surplus rainfall). A favorable monsoon outturn and range-bound commodity prices will enable to start easing monetary policy from Oct-Dec 2024, with likelihood of a cumulative 50 bps rate cut by Mar-25.

Table 2: Market participants expect at least 2 rate cuts from the US Fed in 2024

Source: CME, QuantEco Research

3. Rupee view

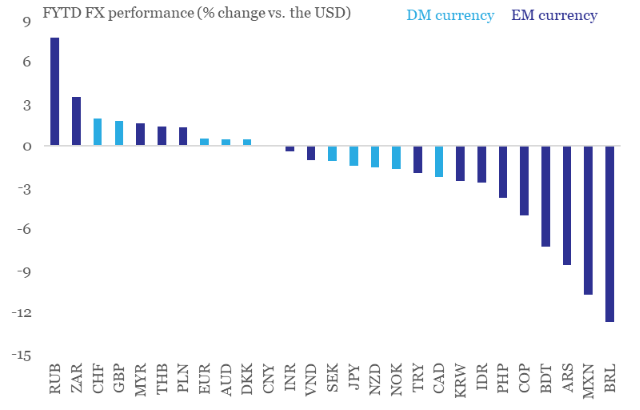

Notwithstanding gyrations in the global currency markets in recent months, the Indian rupee posted a stable performance in the financial year 2024-25 so far. With domestic general elections and the Union Budget pointing towards policy continuity, we expect the underlying macro-stability anchor for the rupee to remain intact.

From a flow perspective, INR is likely to remain in a comfortable zone:

- India’s current account deficit narrowed to 0.7% of GDP in FY24 (the lowest in the post COVID phase) from 2.0% in FY23. After adjusting for capital flows, the accompanying balance of payment registered a strong surplus of USD 64 bn in FY24.

- For FY25, we expect current account deficit to show a mild increase to 0.9% of GDP (though much lower than the long-term trend of 1.5%). However, expectation of recovery in FDI flows along with healthy FPI flows (amidst India’s inclusion in global bond indices) should help to generate a healthy BoP surplus of USD 50 bn.

Chart 3: Rupee has been one of the most stable currencies

Note: FYTD change is between 26-Jul-24 & 1-Apr-24; DM/EM imply Developed and Emerging Markets respectively

Source: CEIC, QuantEco Research

Meanwhile, global factors like uncertainty around the US presidential elections (to be held in Nov-24), geopolitical risks in the Middle East, and build-up of depreciation pressure on the Chinese yuan could potentially result in weakness for rupee. Overall, rupee’s 8-9% overvaluation, and RBI’s inclination for reserve accumulation would tilt the balance in favor of a mild depreciation. We maintain our call of USDINR moving towards 84.50 levels by Mar-25 vs. FY24 close of 83.43.

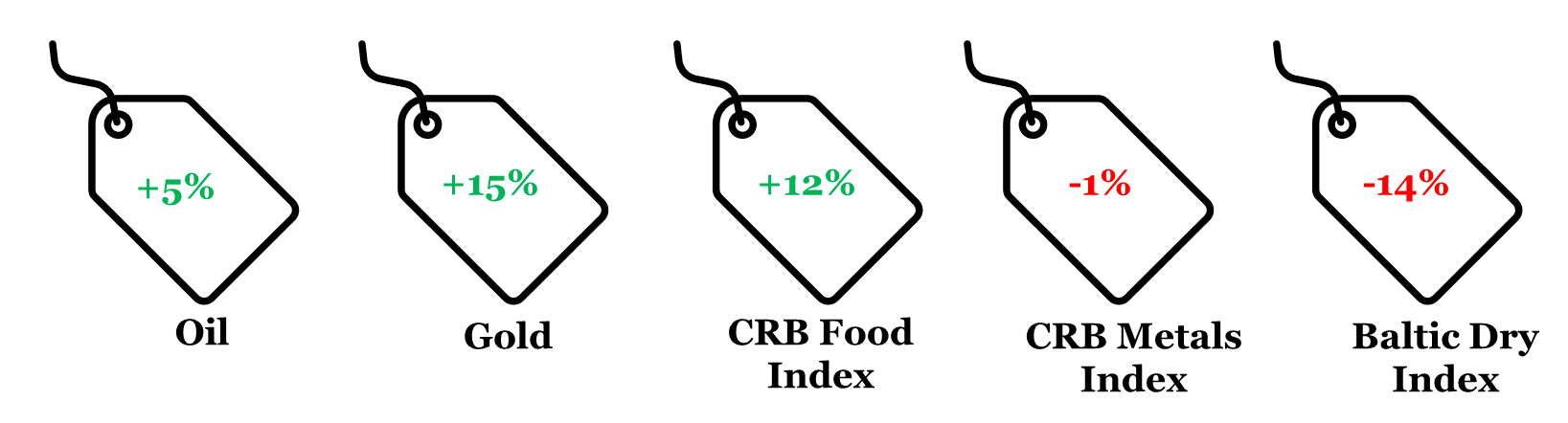

4. CYTD price change in key commodity groups and shipping cost

Note: (i) Price change is between Jul 26, 2024 and Dec 31, 2023; (ii) Oil price is represented by Brent; (iii) rounded off figures represented, (iv) While BDI has declined on CYTD basis, other shipping cost indicators like the VHBS ConTex Index has risen 163% on CYTD basis.

Data: CEIC, QuantEco Research