The Apr-Jun 2025 quarter marked a turning point in the global economy, with rising trade barriers and geopolitical tensions dampening global demand. Amidst this, India stayed focused on stability and trade openness, eyeing key bilateral agreements like the anticipated India-US BTA.

Credlix

1. Sharp escalation of geoeconomic and geopolitical uncertainties

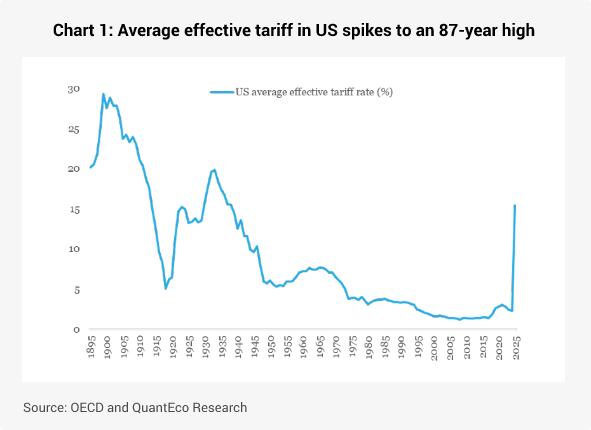

The Apr-Jun 2025 quarter has turned out to be a watershed moment for the global economy. The ongoing quarter witnessed unprecedented uncertainty on the prospects of international trade, triggered by widespread imposition of tariffs by the US President Trump1. As per the OECD, the average effective rate of tariff imposed by the US shot up from 2.3% in 2024 to an estimated level of 15.4% currently2 – this puts it at the highest level in 87 years.

Notably, this weighted average tariff could change in the coming months as the country level tariffs would eventually get determined by the outcome of bilateral trade/investment deals that the Trump led US administration is impressing upon3.

The US imported USD 87 bn worth of goods from India in 2024, making it the 10th largest import partner, with a share of 2.7%. From India’s perspective, the US was the largest export destination in 2024, having a share of 18.2%.

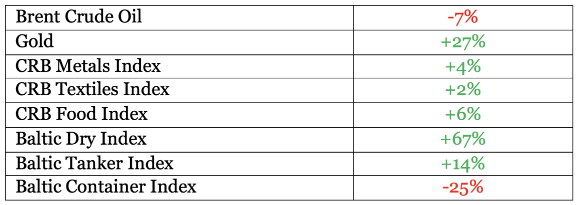

Of the total items exported by India to the US in 2024-25, the share of top 15 items (based on HS Code classification) constituted 80.2% in value terms, with Electrical equipment, Gems & jewellery, Pharmaceutical products, Machinery items, Textiles, and Iron & steel forming the bulk of the shipment.

Table 1: India’s exports to the US is concentrated in top 15 items

Source: Ministry of Commerce and QuantEco Research

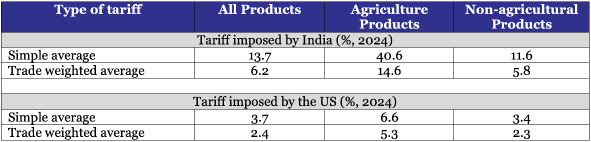

The US had in place a weighted average MFN rate of tariff of 2.4% on India as of end 2024. The US President Trump proposed a reciprocal tariff rate of 26% for India in his ‘Liberation Day’ announcement4. Within a week, this was pruned to a baseline reciprocal tariff rate of 10% for all countries (except China) for a temporary period of 90-days.

Table 2: Broad overview of tariffs: India vs. the US

Source: WTO and QuantEco Research Note: India’s tariffs are likely to be marginally lower than the reported figures by the WTO as it does not take into account select easing of custom duty announced in the Union Budget for 2025-26.

The status of US tariffs will be up for assessment on July 9th, when the temporary tariff truce period ends. As per media reports, the trade and commerce ministries in both countries are working towards announcing the first leg of the India-US Bilateral Trade Treaty (BTA) before the July 9th deadline. News reports suggest that while there has been significant progress on bilateral negotiations, differences on tariffs and market access with respect to agricultural items still need to get ironed out.

Meanwhile, India announced its FTA with the UK in May 2025 (details provided in the box below). In the next few months, the deal will get its fine print and is expected to get implemented from 2026 onwards in a phased manner. This will hopefully provide a template for the anticipated trade agreements with the US and the EU.

India and EU will review their FTA negotiations and finalize a strategic agenda during European Commission President’s visit in Mar-25. Upon finalization, this would become India’s largest ever FTA, granting improved market access for sectors such as textiles, leather, and marine products. The EU is India’s second-largest export market after the US.

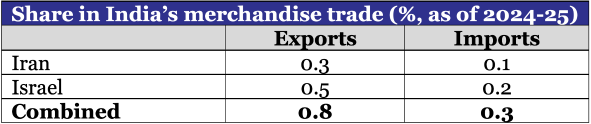

Even as the tariff related uncertainty clouds the global economic outlook, the geopolitical risk in West Asia has spiked with the intense armed conflict between Israel and Iran that began from Jun 13th. Although there is reportedly a ceasefire (with intermediation by the US) now, the situation remains fragile.

The simmering of geopolitical risk in the Middle East since the Israel-Hamas war in 2023 has weighed upon trade activity. India’s combined merchandise trade with Israel and Iran stood at just USD 5.4 bn in 2024-25, down from USD 8.4 bn in 2023-24. Key products involved in trade with both the nations include Cereals, Edible fruits & nuts, Gems & jewellery, Ceramic products, etc.

Source: WTO and QuantEco Research

Given limited trade exposure, any potential escalation of the Israel-Iran armed conflict would have insignificant direct implications for India. However, Iran has strategic control of the Strait of Hormuz, a key chokepoint for world energy trade that witnessed ~27% of maritime energy trade volume in 2023 (as per estimates by the US EIA). In case of a severe escalation, the possibility of closure of the Strait of Hormuz cannot be dismissed. In a worst case scenario, this could lead to a temporary sharp spike in crude oil price, which could impact import dependent economies like India. As per RBI’s estimates, for every $10 increase in crude oil price (assuming complete pass-through):

• CPI inflation moves up by 30 bps

• GDP growth moderates by 15 bps

While having these statistical sensitivities of India’s growth-inflation balance to the price of crude oil is useful, we do acknowledge that crude oil prices have retreated currently on the back of the talk of ceasefire between Israel and Iran – from a high of $80 pb seen earlier in the month, the price of Brent has corrected to $68 pb currently. Notably, the average price of Brent during Apr-Jun 2025 is tracking $68 pb, lower than the average price of $76 pb seen in Jan-Mar 2025 quarter s well as lower than the average price of $85 pb recorded in the Apr-Jun 2024 quarter.

India-UK Free Trade Agreement

On May 6, 2025, India and the UK announced the successful conclusion of the bilateral FTA after negotiating for more than three years. The FTA takes place in the backdrop of growing economic relations between India and the UK as exemplified in the bilateral trade of about USD 60 bn (total merchandise trade stood at USD 23 bn in 2024-25 with India having a USD 6 bn surplus) which is projected to double by 2030. At a broader level, the India-UK FTA is notable for its spread that encompasses goods and services, digital trade, government procurement, intellectual property, labour, gender, anti-corruption and environmental standards.

Select highlights:

• Nearly 44% of India’s exports to UK (like textiles, footwear, carpets, cars, seafood, fruits, etc.) will now get duty-free access. These items earlier faced duties ranging between 4-16%. The remaining ~66% of India’s exports (covering petroleum, pharma, gems & jewellery, vehicle parts already had duty-free access).

• In return, India will cut tariffs on 90% of UK goods. At the onset, 64% of these would get duty-free access (involving items like salmon, lamb, aircraft parts, machinery, and electronics). Over a period of 10 years, India will lower tariffs on the remaining 26% of UK goods (like chocolates, soft drinks, cosmetics, and auto parts) in a phased manner.

• UK will provide 1800 visas on annual basis for independent service professionals (like yoga instructors, musicians, chefs), contractual service suppliers (business visitors, investors, etc.).

• India will grant UK firms the access to central government’s procurement in sectors such as transport, green energy, and infrastructure.

• Indian workers temporarily in the UK will now be exempted from paying social security contributions in the UK for a period of 3 years under the Double Contribution Convention.

Monetary Policy: US Fed maintaining caution while RBI goes for growth

After cutting interest rate by a cumulative 100 bps in 2024, the US Federal Reserve has been on pause since then. At its monetary policy review in June 2025, the median economic forecast by Fed governors point towards a worsening of the growth-inflation balance for both 2025 and 2026:

• GDP growth forecasts for 2025 and 2026 were revised lower by 30 bps and 20 bps to 1.4% and 1.6% respectively.

• Core PCE inflation forecasts for 2025 and 2026 were revised up by 30 bps and 20 bps to 3.1% and 2.4% respectively

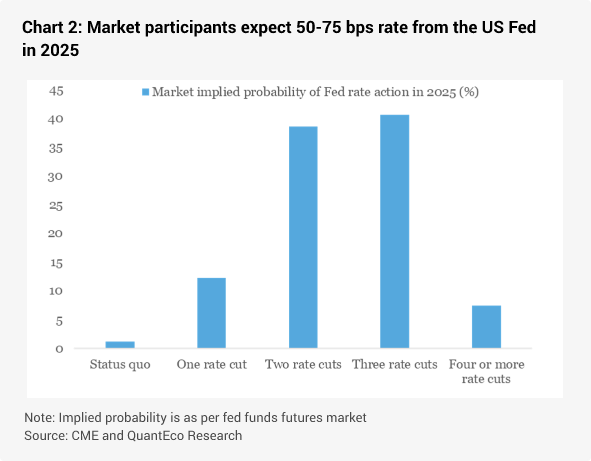

As such, the FOMC (Federal Open Market Committee) in its June 2025 policy review not just maintained its policy rate in the 4.25-4.50% range, but more importantly, it continued to project space for 50 bps cumulative rate easing before the end of 2025, while reducing the cumulative rate cut in 2026 to 50 bps from 75 bps earlier.

In recent weeks, the US economic data, esp. labour market indicators, has turned soft. In addition, the political pressure to ease interest rates has seen a build-up. As such, market participants are currently pricing in 125 bps cumulative rate cut over 2025-2026, higher than Fed’s projection of 100 bps.

Contrary to the conditions in the US, where the tariff threat is expected to weigh upon inflation, which in turn is keeping the Fed cautious – India, is witnessing a strong disinflationary pressure from food items. In its last monetary policy review in June 2025, the RBI revised lower its CPI inflation forecast by 30 bps to 3.7% – if realized this will be the lowest inflation in the post COVID period. With inflation projected to be lower than the 4% target, the RBI used the space to deliver 50 bps cut in the repo rate to 5.50%. This was accompanied by the announcement of 100 bps reduction in the CRR (Cash Reserve Ratio for banks) to 3.00%. The jumbo-sized policy easing was balanced by a shift in the monetary policy stance to ‘neutral’ from ‘accommodative’ – essentially implying status quo in the near future with data dependent action thereafter. We expect this will provide clarity to the banking and financial system and boost monetary policy transmission, in favor of lower interest rates in the economy.

3. Rupee view

After two back-to-back months of appreciation in February and March 2025, the Indian rupee posted a modest depreciation of 0.5% in May 2025 vs. the US dollar. The month of June 2025 so far has witnessed an extension of this trend, with INR losing 0.5% vs. the USD.

The broader theme of USD weakness continues to dominate the global FX market sentiment amidst heightened policy uncertainty in the US. Currencies like the CHF and EUR have seen the maximum strength against the USD amongst developed market currencies, while RUB and KRW have posted strong performance amongst emerging market currencies.

While USD continues to see some erosion of its safe haven appeal, the bearish market positioning is getting stretched – this could potentially reverse in the short-term, hopefully dovetailing with ebbing of heightened trade uncertainties by Sep-25. US Fed’s wait-and-watch approach, in contrast to other key central banks that have eased monetary policy in recent months, could also provide a minor tailwind to the USD.

Meanwhile, INR could enjoy strategic gains in the near term on account of recent slide in inflation and the front loading of exports to the US. However, we believe this to be transitory, and likely to be actively defended by RBI intervention to recoup reserves. We maintain our medium-term call of moderate weakness in the INR and expect it to drift towards 89.50 by Mar-26 for now. We shall review the call post the announcement of the India-US BTA.

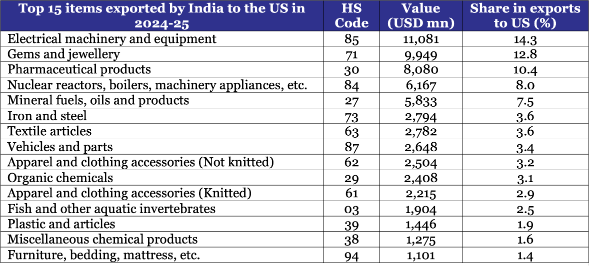

4. CYTD price change in key commodity groups and shipping cost