In this month, we focus on the outlook for global trade and its implications for India. With the Red Sea disturbance about to complete a full year, we take stock of trade activity along with a peak at maritime freight cost. This is followed by a quick assessment of US and India’s monetary policy along with the outlook on the Indian rupee.

1. Global trade to improve in 2025, but significant risks remain

Notwithstanding the elevated geopolitical uncertainty, global merchandise trade volume has expanded (as estimated by the CPB Netherlands) by 1.3% during Jan-Jul 2024 compared to an anaemic growth of 0.1% seen in the corresponding period in 2023. Bulk of this has come on the back of strong import demand from the UK and US along with strong export performance by China. Among major economies, Eurozone and to some extent Japan posted a disappointing performance on real merchandise trade activity in the first seven months of 2024.

We note that the World Trade Organization has upped its forecast for growth in global merchandise trade volume by 10 bps to 2.7% in its bi-annual assessment of global trade. This would be the best performance in the post COVID phase, barring 2021 that saw an exceptionally high growth as unlocking of economies allowed pent-up trade activity to pass through.

For 2025, while the WTO revised lower its forecast for world trade volume growth by 30 bps to 3.0%, it nevertheless indicates improvement over the 2024 momentum.

Moderation in global inflationary pressure has allowed many central banks to ease monetary policy. This should support consumption/investment, which in turn would help in a gradual recovery of global trade. However, the WTO acknowledges that significant downside risks remain, including regional conflicts, geopolitical tensions and economic policy uncertainty.

Chart 1: After a contraction in 2023, global merchandise trade volume is expected to recover in 2024 and 2025

Source: WTO and QuantEco Research

From India’s perspective, the expectation of revival in global trade is comforting – after all, merchandise exports and services exports had a share of 12.4% and 9.6% in India’s GDP in FY 2023-24. We take a regional look at what could drive this revival from India’s perspective.

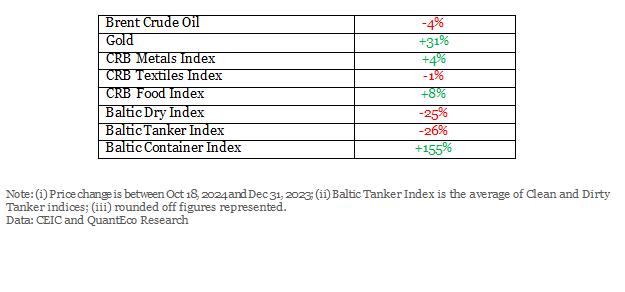

As per the WTO, growth in demand for imports on volume basis is expected to be the strongest for countries in Asia over 2024 and 2025. This is expected to be followed by countries in South America and North America. While the Middle East is expected to see strong demand in 2024, the same could peter out completely in 2025. Meanwhile, demand from Europe, CIS countries, and Africa is likely to remain subdued over 2024 as well as 2025.

Table 1: Regional heatmap depicting growth in volume of merchandise import demand

2. An update on the Red Sea crisis and shipping cost

It’s been almost one year since the Houthi movement started escalating with targeted attacks on ships crossing the Red Sea trading route (that is known to handle ~15% of global maritime trade). The attacks led many carriers to avoid the Red Sea route altogether, and opting for a detour with vessels going around the Cape of Good Hope in Africa. For most trade routes, rerouting via the Cape of Good Hope results in minimal delays, but Asia-Europe is an exception, experiencing additional travel time of 1-3 weeks compared to the more direct route via the Red Sea.

As per the current situation, as of Sep-24:

· Transit trade volume via the Bab-el-Mandeb Strait (a critical choke point in the Red Sea route that has seen concentration of attacks by the Houthis) was lower by 79.3% on annualized basis

· In contrast, the transit trade volume via the Cape of Good Hope (located at the southern tip of Africa) is up by 42.4% on annualized basis

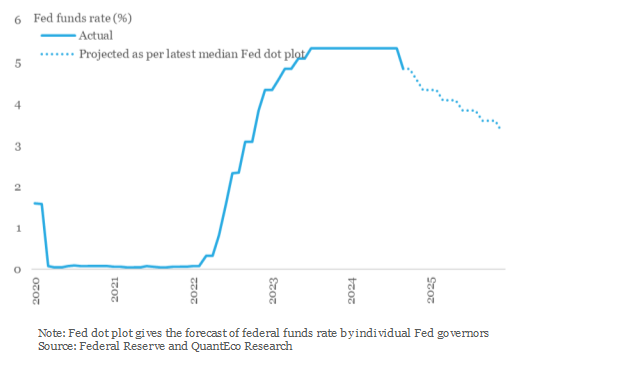

Global maritime trade cost presents a mixed picture in 2024 so far. At one end, the Baltic Dry Index and the Baltic Tanker Index is down ~28% and ~23% in 2024 so far, the Baltic Container Index is up by a whopping ~170%. Although maritime freight volume carried by containers is about 13%, their share in the value of maritime trade is high at around 66%. Hence, although the sharp rise in container freight cost this year is unlikely to have a meaningful impact on the volume of maritime trade, it is bound to impact its overall cost.

The rise in freight costs can be attributed to several factors that include increased consumption demand, strikes in the transportation sector, shipping accidents, and extreme weather events. In recent months, the North American freight market has faced significant challenges such as a rail strike in Canada and the collapse of the Baltimore bridge. In last 6 months, China has faced disruptions in port activity on account of heavy fog and typhoons, while Malaysia and Singapore experienced delays due to heavy rainfall.

3. India’s export performance during the first half of FY 2024-25

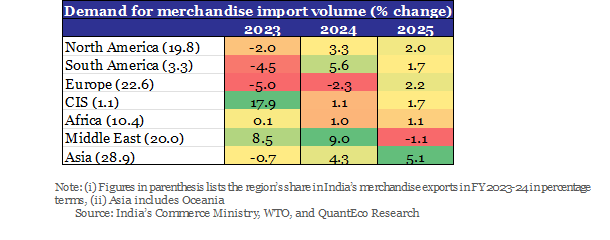

As per preliminary estimates from the Ministry of Commerce, India’s merchandise exports grew at a tepid rate of 1.0% to USD 213 bn during Apr-Sep FY 2024-25 from USD 211 bn in the corresponding period in FY 2023-24. At a granular level:

· Top 5 items that recorded the fastest growth were Gold, Raw Silk, Silver, Aircraft/Spacecraft parts, and Computer hardware.

· Bottom 5 items in terms of growth were Wheat, Mollases, Processed Meat, Project Goods, and Wood products.

· The annualized share of Electronic items in India’s export basket currently stands at its highest level of 7.2%.

· The annualized share of Gems and jewellery items in India’s export basket currently stands at its lowest level of 7.1%.

Chart 2: There was wide variation in the performance of key export categories during Apr-Sep FY 2024-25

3. Monetary Policy Shift: Fed’s jumbo action to drive global rates lower

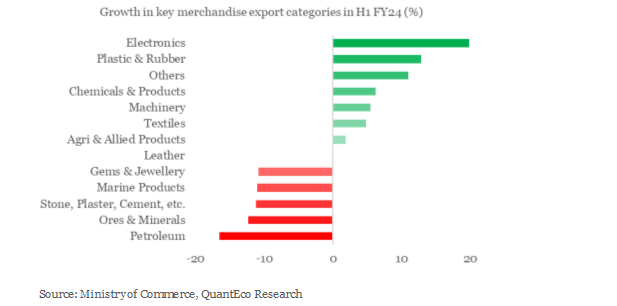

The US Federal Reserve finally joined the rate easing cycle with a jumbo sized 50 bps rate cut in Sep-24. More importantly, the Fed officials indicated at the possibility of another 50 bps rate before the end of 2024, followed by another 100 bps rate over the course of 2025. If realized, this will take the US monetary policy rate from its current range of 4.75-5.00% to 3.25-3.50% before the end of 2025.

With inflation moderation progressing at a gradual pace, the Fed now appears confident of meeting its inflation target in 2026. Meanwhile, although demand conditions appear relatively

healthy, gradual build-up of concerns has prompted the Fed to now start laying equal emphasis on its dual mandate of price stability and maximum employment.

The ongoing moderation in inflation pressures in 2024 over 2023 has prompted many central banks to start monetary easing. With the US Fed taking a bold and decisive step, other central banks might get influenced to replicate monetary policy easing actions in their respective economies. From India’s perspective, we note that the RBI shifted its monetary policy stance to ‘neutral’ from ‘withdrawal of accommodation’ in its Oct-24 policy review. While the shift in monetary policy stance happened without any change in the monetary policy rate (repo rate continues to remain at 6.50%), we believe it is a precursor for easing of interest rates in the near future. Depending upon the anticipated correction in domestic food prices and its overall impact on CPI inflation, market participants expect the RBI to deliver its first rate cut in either Dec-24 or Feb-25 policy review.

Chart 3: US monetary policy rate is set to decline further in 2025

4. Rupee view

The Indian rupee touched a record low as it breached the 84 level against the US dollar in Oct-24. The depreciation pressures are a culmination of the following factors:

· Broad based strength in the US dollar on account of a relatively better economic position of US vis-à-vis its peers

· Elevated geopolitical tensions in the Middle East and uncertainty on the prospects of global trade (esp. in the backdrop of upcoming US presidential election in Nov-24) have supported the safe haven demand for the dollar.

· Meanwhile co-ordinated policy easing in China is resulting in weakness in the Chinese yuan, which in turn is putting pressure on emerging market currencies

· Basis the RBI’s Real Effective Exchange Rate index (a trade weighted average exchange rate that adjusts for inflation differentials with the trading partner), the rupee is 7-8% overvalued compared to the long period average. As such, any depreciation in the currency helps to correct for the inherent overvaluation.

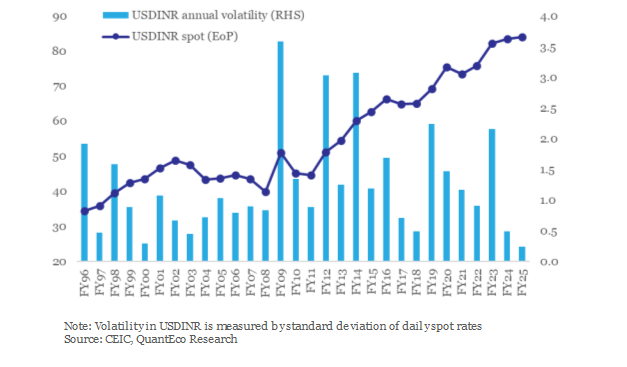

Despite the record weakness in the India rupee, the currency has seen extremely low levels of volatility. Relatively stable underlying macroeconomic balance characterized by high growth, moderate inflation, lower than trend trade deficit, correcting fiscal imbalances, and record high FX reserves bode well from the perspective of India’s global appeal and its currency stability.

Overall, we maintain our call of USDINR moving towards 84.5 levels by Mar-25.

Chart 4: Record weakness in the rupee spot rate is accompanied by record low volatility

5. CYTD price change in key commodity groups and shipping cost